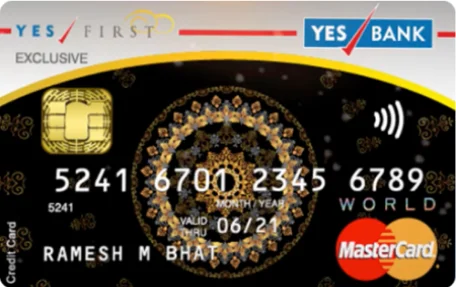

YES First Exclusive Credit Card

Welcome to the epitome of luxury and exclusivity, the YES First Exclusive Credit Card. Crafted for those who demand nothing but the best, this card transcends ordinary credit offerings. Join us on a journey to explore how the YES Bank First Exclusive Credit Card brings a new level of sophistication to your financial realm, redefining the way you experience opulence and convenience in every transaction.

The YES First Exclusive Credit Card is a premium offering from YES BANK that brings together a blend of luxury, rewards, and exclusive benefits. Tailored for those who seek an elevated lifestyle experience, this credit card offers an array of exceptional privileges. From generous reward points that can be redeemed for travel and accommodation to complimentary access to both domestic and international airport lounges, this card caters to the desires of the discerning traveler. Positioned as a direct competitor to other prestigious credit cards, the YES First Exclusive Credit Card not only embodies elegance but also provides substantial value through its versatile rewards program and enticing discounts. Whether it’s indulging in airport lounges or unlocking attractive offers on entertainment, this credit card encapsulates the essence of a luxurious lifestyle while delivering practical financial advantages.

Features and Benefits of YES First Exclusive Credit Card

Low Interest Rate: Only 2.99% interest on unpaid balances.

8000 Bonus Reward Points: Earn exclusive points on spending and use them with YES Rewardz.

Better Currency Markup: Enjoy a low 1.75% foreign currency markup.

Golf Privileges: Play golf with 4 green fee waivers and 1 golf lesson annually.

Insurance Coverage: Stay secure with INR 3 Crore life insurance, INR 50 Lakhs medical insurance, and INR 15 Lacs credit shield cover.

Fuel Savings: Save 1% on fuel charges for transactions between Rs 400 and Rs 5000.

International Lounge Access: Use 6 free airport lounge visits each year.

Domestic Lounge Access: Enjoy 3 free lounge visits every quarter within India.

Dining Discounts: Get at least 15% off at selected restaurants using your YES Bank Credit Card.

Travel and Dining Rewards: Gain 24 reward points for every INR 200 spent on travel and dining (up to 5,000 per cycle).

All Categories Rewards: Earn 12 reward points for every INR 200 spent across all categories. Also, 6 points for specific categories.

Renewal Bonus: Receive 8,000 extra reward points after annual membership renewal from the second year onward.

Air Miles Conversion: Convert 10 reward points to 1 InterMile or 1 Club Vistara Point for air travel benefits.

YES First Exclusive Credit Card Fees and Charges

Joining Fee: Rs. 1999 (plus applicable taxes)

No First-Year Fee: Spend INR 40,000 within 30 days of card setup to avoid the INR 1,999 fee plus taxes for the first year.

Renewal Fee: Rs. 1999 + taxes

Renewal Fee Waiver: Spend INR 3,00,000 or more in the year before your card renewal to skip the INR 1,999 fee plus taxes.

Transaction Fees: For rental and wallet transactions above Rs 1, pay 0.50% of the transaction value or at least Rs 1 (whichever is higher).

Note: Rental transactions are limited to 3 every 30 days.

YES Bank’s Other Cards

YES Premia Credit Card

YES Prosperity Edge Credit Card

YES Prosperity Rewards Plus Credit Card

YES First Preferred Credit Card

YES Bank RuPay Credit Card

YES Bank BYOC Credit Card

YES Private Prime Credit Card

YES Bank Wellness Plus Credit Card

YES Bank Wellness Credit Card

YES Prosperity Cashback Plus Credit Card

YES Prosperity Rewards Credit Card

YES Bank EMI Credit Card

YES First Exclusive Credit Card Eligibility

Age Requirement: You should be between 21 and 60 years old.

Employment Types: Both people who earn a salary and those who work for themselves can apply.

Income Criteria: You need a minimum monthly net salary of INR 2 lakh or an income tax return of INR 18 lakh and above.

Documents Required for YES First Exclusive Credit Card

The documents required to apply for this credit card are listed below:

ID Proof: Any of these – Aadhar Card, Driver’s License, Voter ID, PAN Card, Passport.

Address Proof: Pick one – Aadhar Card, Recent Utility Bills, Rent Agreement, Ration Card, Passport.

Income Proof: Choose – Recent Salary Slips/Bank Statements (for employed), Latest Audited ITR (for self-employed).

How to apply for YES First Exclusive Credit Card?

Online Application:

- Visit the YES Bank official website ( https://www.yesbank.in/ )

- Look for the section ‘credit cards’.

- Locate the YES First Exclusive Credit Card and click on “Apply Now”.

- Fill out the online application form with your personal, contact, and financial details.

- Provide the required documents, such as identity and address proofs, income proofs, etc.

- Review the information you’ve provided and submit the application.

Offline Application:

- Visit a YES Bank branch nearest to you.

- Speak to a bank representative and express your interest in applying for the YES First Exclusive Credit Card.

- They will provide you with the necessary application form to fill out.

- Complete the form with accurate information and attach the required documents.

- Submit the filled application form and documents to the bank representative.

Frequently Asked Questions (FAQs) -

The YES First Exclusive Credit Card is an elite credit card offered by YES Bank, designed to provide exclusive privileges and benefits to high-net-worth individuals.

- Comprehensive travel benefits

- Exclusive lifestyle privileges

- Reward points on every transaction

- Concierge services

- Airport lounge access

- Comprehensive insurance coverage

You can apply for the YES First Exclusive Credit Card by visiting the official YES Bank website or contacting the bank’s customer service. The application process may require you to submit certain documents and meet specific eligibility criteria.

Eligibility criteria may vary, but generally, applicants should have a high income, a good credit score, and meet other financial criteria set by YES Bank.

The annual fee for the YES First Exclusive Credit Card, along with any other applicable charges, can be found on the YES Bank website or by contacting the customer service team.

The YES First Exclusive Credit Card typically offers a rewards program where you earn points for every transaction. These points can be redeemed for a variety of rewards, including travel, merchandise, or cashback.

Travel benefits may include complimentary airport lounge access, travel insurance coverage, discounts on airfare, and hotel bookings, among other perks. The specific benefits may vary, so it’s recommended to review the terms and conditions.

It’s essential to check the terms and conditions, as foreign transaction fees may apply. Some premium credit cards, including the YES First Exclusive Credit Card, may offer reduced or waived foreign transaction fees.

You can reach YES Bank’s customer support through their helpline number, email, or by visiting a local branch. The contact details are usually available on the official YES Bank website.

Yes, a grace period is typically provided for bill payments. It’s crucial to pay the outstanding balance within this period to avoid any additional charges. The exact details of the grace period can be found in the terms and conditions provided by YES Bank.