Best Cashback Credit Cards in India

Cashback credit cards are a great way to earn money back on your spending. There are many best cashback credit cards available in India, so it is important to compare the different options before you apply for one.

When choosing the best cashback credit card, it is important to consider your spending habits and the rewards program that best suits your needs. You should also compare the annual fees and other fees and charges before you apply for a card.

Best Premium Cashback Credit Cards in India

Premium cashback credit cards are those credit cards that offer enhanced cashback rewards and additional benefits for cardholders who meet certain spending criteria. These cashback credit cards are typically targeted at individuals with higher incomes and excellent credit scores.

Here are list of some best premium cashback credit cards in India –

HDFC Bank Millennia Credit Card

HDFC Bank Millennia Credit Card is a good option for high-spending individuals who are looking for a credit card with a variety of benefits. However, it is important to note that the card has a high annual fee and high-interest rates.

Welcome benefits:

-

- 1,000 bonus cash points

Eligibility:

-

- A credit score of at least 750

- Annual income of at least ₹10 lakh

Axis Bank ACE Credit Card

Axis Bank ACE Credit Card is a good option for people who want to earn cash back on their everyday spending. This credit card has a high-interest rate, and eligibility requirements are strict.

Welcome Benefits

-

- Joining fee waived off on spends greater than Rs.10,000 within 45 days of card issuance.

- Rs.500 cashback after 3 transactions (min Rs. 500 each) within 45 days of card issuance.

Eligibility:

-

- A credit score of at least 750

- An annual income of at least Rs. 3 lakh

SBI Cashback Credit Card

The Cashback SBI Card is a credit card that offers cashback on all online and offline spending. It offers 5% cashback on all online spending and 1% cashback on all offline spending. The card also offers a 1% fuel surcharge waiver and no annual fee.

Welcome Benefits

-

- 500 welcome points: You will get 500 welcome points when you spend Rs. 3,000 in the first 3 months of card activation.

- 1% fuel surcharge waiver: You will get a 1% fuel surcharge waiver on fuel spends of Rs. 400-3,000 per month.

Eligibility

-

- An annual income of at least Rs. 3 lakh

- A credit score of at least 750

Citi Cash Back Credit Card

Citi Cash Back Credit Card is a credit card that offers cashback on all online and offline spending. It offers 0.5% cashback on all spends and 5% cashback on movie ticket purchases, telephone bill payments, and utility bill payments. The card also offers a 1% fuel surcharge waiver and no annual fee.

Welcome Benefits

-

- 500 reward points: You will get 500 reward points when you spend Rs. 3,000 in the first 3 months of card activation.

- 1% fuel surcharge waiver: You will get a 1% fuel surcharge waiver on fuel spends of Rs. 400-3,000 per month.

Eligibility

-

- An annual income of at least Rs. 3 lakh

- A credit score of at least 750

Standard Chartered Super Value Titanium Credit Card

The Standard Chartered Super Value Titanium Credit Card is a good option for people who want to earn cashback on their fuel, telephone, and utility bills. The card is also a good option for people who want to save money on fuel surcharges.

Welcome Benefits

-

- 100% cashback up to Rs. 1,500: You will get 100% cashback up to Rs. 1,500 on all fuel purchases made within the first 90 days after card issuance.

Eligibility

-

- An annual income of at least Rs. 3 lakh

- A credit score of at least 750

Co-branded Cashback Credit Card:

Co-branded cashback credit cards are credit cards that are issued in partnership between a credit card issuer and a specific brand or retailer. These cards are designed to provide cardholders with cash-back rewards and benefits that are tailored to the brand’s products, services, or loyalty programs. Co-branded cashback credit cards offer an opportunity for cardholders to earn cashback or rewards points that can be redeemed within the partner brand’s ecosystem.

Amazon Pay ICICI Bank Credit Card

The Amazon Pay ICICI Bank Credit Card is a good option for people who are frequent Amazon shoppers and want to earn cashback on their purchases. The card also offers a complimentary Amazon Prime membership, which can save you money on shipping and other benefits.

Welcome Benefit

-

- Flat Rs. 200 (Prime members) or Rs. 150 (Non-Prime members) cashback: You will get a flat cashback of Rs. 200 (for Prime members) or Rs. 150 (for Non-Prime members) on your first transaction on Amazon shopping, bill payments & recharges.

- Amazon Pay balance worth Rs. 1,500 (Prime members) or Rs. 1,250 (Non-Prime members) + 3 months Prime membership: You will get an Amazon Pay balance worth Rs. 1,500 (for Prime members) or Rs. 1,250 (for Non-Prime members) + 3 months of Prime membership.

- 5% cashback on Amazon.in: You will get 5% cash back on all purchases made on Amazon.in.

- No annual fee: The Amazon Pay ICICI Bank Credit Card does not have an annual fee.

Eligibility

-

- An annual income of at least Rs. 3 lakh

- A credit score of at least 750

Flipkart Axis Bank Credit Card

The Flipkart Axis Bank Credit Card is a good option for people who are frequent Flipkart shoppers and want to earn cashback on their purchases. The card also offers other benefits, such as complimentary airport lounge access and discounts on Flipkart flights.

Welcome Benefit

-

- Rs. 500 worth of Flipkart vouchers on your first transaction with your Flipkart Axis Bank credit card.

- 5% cashback on Flipkart & Myntra

- 4% cashback on Preferred Merchants

- 1.5% cash back on all other categories

- Fuel surcharge waiver

- No annual fee

Eligibility

-

- An annual income of at least Rs. 3 lakh

- A credit score of at least 750

Myntra Kotak Credit Card

The Myntra Kotak Credit Card is a credit card that offers cashback on Myntra and Flipkart purchases, as well as other benefits such as no annual fee and complimentary airport lounge access.

Welcome Benefit

-

- Myntra voucher worth Rs. 500.

Eligibility

-

- An annual income of at least Rs. 3 lakh

- A credit score of at least 750

RBL Bank Edition Credit Card

The RBL Bank Edition Credit Card is a co-branded credit card launched by RBL Bank in collaboration with Zomato. It is a premium card offering exclusive benefits to Zomato users, such as Edition Cash, complimentary airport lounge access, and a low foreign currency markup fee.

Benefits

-

- Complimentary airport lounge access

- Low foreign currency mark-up fee

- Unlimited cashback on dining

- Travel Insurance

- Purchase protection

Annual Fee

-

- The annual fee for the RBL Bank Edition Credit Card is Rs. 1,499 + GST.

- The annual fee gets waived if you spend Rs. 4,00,000 in the preceding year.

Eligibility

-

- Be a resident of India

- Have a minimum annual income of Rs. 3 lakhs

- Have a good credit score

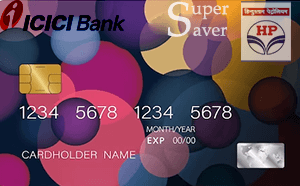

ICICI Bank HPCL Super Saver Credit Card

The ICICI Bank HPCL Super Saver Credit Card is a great option for those who frequently fuel up at HPCL petrol pumps. The card offers up to 6.5% cashback on fuel spending, as well as other benefits such as complimentary airport lounge access and travel insurance.

Benefits

-

- Up to 6.5%, cashback on fuel spends

- 1.5% reward points on fuel spent made using the HP Pay app

- Complimentary airport lounge access

- Travel Insurance

- Purchase protection

- No annual fee if you spend Rs. 1,50,000 or more in a year

Eligibility

-

- Minimum age of 21 years

- A minimum annual income of Rs. 3 lakhs

- Good credit score

Other Best Cashback Credit Cards in India

Standard Chartered Smart Credit Card

Annual fee: Rs. 499 + GST

Welcome offer: 500 Smart Reward points on spending Rs. 3,000 in the first 30 days

Rewards: 1 Smart Reward point for every Rs. 100 spent

Benefits: Complimentary airport lounge access, travel insurance, purchase protection, and no forex markup

Eligibility: Minimum age of 21 years, minimum annual income of Rs. 3 lakhs, and good credit score

HSBC Cashback Credit Card

Welcome offer: 500 HSBC Reward points on spending Rs. 3,000 in the first 30 days

Rewards: 1 HSBC Reward point for every Rs. 100 spent on fuel, groceries, and dining

Benefits: Complimentary airport lounge access, travel insurance, purchase protection, and no forex markup

Eligibility: Minimum age of 21 years, minimum annual income of Rs. 3 lakhs, and good credit score

YES Prosperity Cashback Plus Credit Card

Welcome offer: Rs. 250 cashback on spending Rs. 2,500 in the first 30 days

Rewards: 5% cashback on movie ticket bookings, shopping, grocery, and utility bill payments

Benefits: 1% fuel surcharge waiver, travel insurance, purchase protection, and no forex markup

Eligibility: Minimum age of 21 years, minimum monthly income of Rs. 25,000, and good credit score