Best Credit Cards in India

Finding an ideal credit card that offers high rewards and complimentary benefits at a minimal or zero membership fee may seem like a utopian concept. In reality, card issuers face financial constraints that make it unfeasible to provide such an advantageous credit card at a low cost. Instead, they focus on offering the best credit cards in India with benefits in different categories, allowing individuals to choose a credit card that aligns with their spending habits. A single “best credit card” concept varies depending on individual requirements and spending behavior. To cater to diverse segments of people, we have compiled a list of the best credit cards in India.

However, it is crucial to conduct thorough research before applying for a credit card. Understanding your spending habits is essential to selecting the most suitable credit card for your needs. With a multitude of credit card options flooding the market, it can be challenging to identify the best credit cards in India and choose the one that suits you best. Don’t worry we have analyse and we have a list for best credit cards in India 2023.

List of Best Credit Cards in India

Once you have determined the category of credit card that best suits your needs, the next step is to narrow down the options to find the best credit cards in India within that category. To simplify this task, we have compiled a list of the best credit cards available in India as of 2023, covering each category currently present in the market. This curated list will help you in making an informed decision and selecting the credit card that aligns with your requirements.

Entry-Level Credit Cards

Entry-level credit cards are designed for individuals who are new to credit or have limited credit history. These cards typically have lower credit limits and fewer benefits compared to premium cards. They offer an opportunity to establish credit, build a positive payment history, and gain access to essential credit card features. Here are our top picks for the best entry-level credit cards in India:

Axis Bank MY ZONE Credit Card

The Axis Bank MY ZONE Credit Card is a popular choice for individuals looking for a versatile and rewarding credit card. With attractive cashback rewards on dining, shopping, and entertainment, it offers personalized benefits to suit individual preferences.

Eligibility:

-

- Primary cardholder should be between 18 to 70 years of age

- Add-on cardholder should be above 15 years of age

- Applicant should be a Resident of India or Non-Resident Indian

Joining Fee:

Nil

Welcome Benefits:

Get SonyLiv Premium annual subscription worth Rs.999 on your first spend within first 30 days of card issuance.

Best Suited For:

Individuals who frequently spend on dining, shopping, and entertainment.

Best Feature:

Cardholders have the flexibility to customize their spending categories to earn higher cashback rewards based on their preferences. This feature allows individuals to maximize their rewards and tailor their credit card usage to suit their unique spending patterns and lifestyle choices.

HDFC Bank MoneyBack Plus Credit Card

HDFC Bank MoneyBack Plus Credit Card is a popular credit card offered by HDFC Bank in India. It is designed to provide rewards and cashback benefits to cardholders.

Eligibility:

-

- The minimum age requirement is 21 years.

- The applicant should have a Gross Monthly Income> ₹20,000

Joining Fee:

Rs. 500 (plus applicable taxes)

Welcome Benefits:

500 Cash Points (applicable only on payment of membership fee)

Best Suited For:

Individuals looking for a credit card with rewards and cashback benefits.

Best Feature:

Earn reward points on all eligible purchases made with the card and redeem them for cashback or exciting merchandise from the HDFC rewards catalog.

AU Bank LIT Credit Card

AU Bank LIT Credit Card is a feature-rich credit card offered by AU Small Finance Bank. Designed to cater to the diverse needs of cardholders, it provides a range of benefits and privileges.

Eligibility:

-

- Primary cardholder between the age of 21 years and 60 years.

- Add-on cardholder should be over 18 years.

- The applicant should have a stable income and a good credit history.

Joining Fee:

Nil

Welcome Benefits:

None

Best Suited For:

Individuals seeking a versatile credit card with attractive features and benefits.

Best Feature:

The AU Bank LIT Credit Card provides a user-friendly digital banking experience, allowing customers to manage their card, payments, and rewards conveniently through a mobile app or online banking platform. It offers a modern and hassle-free approach to credit card usage.

Cashback SBI Credit Card

Cashback SBI Credit Card is a credit card offered by the State Bank of India (SBI) that provides attractive cashback rewards on eligible transactions.

Eligibility:

-

- Be between 21 and 65 years old.

- Have a stable source of income.

- Have a decent credit history.

Joining Fee:

Rs. 999

Welcome Benefits:

None

Best Suited For:

This credit card is ideal for individuals who frequently make purchases and want to earn cashback on their spending.

Best Feature:

The Cashback SBI Credit Card offers attractive cashback rewards on various categories such as dining, groceries, fuel, and more. Earn cashback on eligible transactions, helping you save money with every purchase.

SBI SimplyCLICK Credit Card

The SBI SimplyCLICK Credit Card is a popular credit card offered by the State Bank of India (SBI). It is designed to cater to the needs of online shoppers and provides various benefits and rewards for online purchases.

Eligibility:

-

- Income: Salaried- Rs. 20,000 per month

Self Employed- Rs. 20,000 per month (as per ITR) - Good credit score

- Income: Salaried- Rs. 20,000 per month

Joining Fee:

Rs. 499 + GST

Welcome Benefits:

Get Amazon.in gift card worth Rs.500* on payment of Annual Fee.

Best Suited For:

Ideal for individuals who frequently shop online, as it offers attractive rewards and benefits for online transactions.

Best Feature:

Earn accelerated rewards on online shopping with partner websites, such as Amazon, Flipkart, Cleartrip, and more.

Axis Bank ACE Credit Card

The Axis Bank ACE Credit Card is a feature-packed credit card in India that offers a range of benefits and rewards for different spending categories.

Eligibility:

-

- The minimum age requirement is 18 years.

- The individual should be a Resident of India.

- The applicant should have a good credit history and a stable income.

Joining Fee:

Rs. 499 + taxes

Welcome Benefits:

None

Best Suited For:

Individuals who frequently shop online, dine out, or travel.

Best Feature:

Earn accelerated reward points on categories such as online shopping, dining, and travel, allowing cardholders to accumulate rewards faster.

American Express SmartEarn Credit Card

American Express SmartEarn Credit Card is a popular credit card in India offered by American Express with a focus on rewarding everyday spending and providing a range of benefits.

Eligibility:

-

- Employed and have a Personal Annual Income of INR 4.5 lakhs and above or Self Employed with a Personal Annual Income of INR 6 lakhs and above.

- Have a good credit history and no payment defaults.

Joining Fee:

Rs. 495 (plus applicable taxes)

Welcome Benefits:

Rs. 500 cashback as a Welcome Gift in form of statement credit on eligible spends of Rs. 10,000 in the first 90 days of Card membership.

Best Suited For:

Individuals who frequently make everyday purchases and want to maximize their rewards.

Best Feature:

Earn 10X Membership Rewards Points on dining, movies, and grocery spends, both online and offline. This allows cardholders to accumulate rewards faster on their everyday expenses.

IDFC FIRST Classic Credit Card

The IDFC FIRST Classic Credit Card is a popular financial product offered by IDFC FIRST Bank. This credit card provides several benefits and features to enhance the cardholder’s spending power and overall banking experience.

Eligibility:

-

- Annual income of ₹ 3 Lacs or more.

- A credit score in the range of 700 or above.

Joining Fee:

Nil

Welcome Benefits:

-

- Welcome voucher worth ₹500 on spending ₹15,000 or more within 90 days of card generation.

- 5% cashback (up to ₹1000) on the transaction value of first EMI done within 30 days of card generation.

Best Suited For:

Individuals looking for a basic credit card with essential features and benefits.

Best Feature:

The IDFC FIRST Classic Credit Card offers the convenience of contactless payments, allowing for quick and secure transactions with just a tap.

Shopping Credit Cards

Shopping credit cards are designed to enhance your retail experience by offering exclusive benefits and rewards. These cards often provide cashback, discounts, and loyalty points for purchases made at partner stores or within specific categories like fashion, electronics, or groceries. With features like EMI options and flexible repayment plans, shopping credit cards enable you to manage your expenses effectively. They are ideal for avid shoppers looking to save money, earn rewards, and enjoy convenient payment options while indulging in their retail therapy. Following are our top picks for the best Shopping credit cards in India:

Flipkart Axis Bank Credit Card

The Flipkart Axis Bank Credit Card is a co-branded credit card offered in partnership between Flipkart, one of India’s leading e-commerce platforms, and Axis Bank, a renowned private sector bank. This credit card is specifically designed to enhance the shopping experience on Flipkart and offers a range of benefits and rewards to cardholders.

Eligibility:

-

- Primary cardholder should be between the age of 18 and 70 years.

- The individual should either be a Resident of India or a Non-Resident Indian.

Joining Fee:

Rs. 500+GST

Welcome Benefits:

Rs. 500 worth Flipkart vouchers on your first transaction with your Flipkart Axis Bank credit card.

15% cashback up to Rs. 500 on your first transaction on Myntra using Flipkart Axis Bank credit card.

50% instant discount up to Rs.100 on 1st Swiggy order. Use code “AXISFKNEW”.

Best Suited for:

Online shoppers who frequently shop on Flipkart and its partner platforms.

Best Feature:

Flipkart Axis Bank Credit Card offers accelerated rewards and exclusive benefits on Flipkart purchases, making it an ideal choice for frequent online shoppers.

Amazon Pay ICICI Bank Credit Card

The Amazon Pay ICICI Bank Credit Card is a co-branded credit card that offers numerous benefits to customers who frequently shop on Amazon India. Issued by ICICI Bank in collaboration with Amazon Pay, this credit card combines the convenience of online shopping with attractive rewards and cashback offers.

Eligibility:

-

- Minimum Income Required: Rs. 25,000 for ICICI Customers

Rs. 35,000 for other applicants - A Credit Score of 750 or above.

- Minimum Income Required: Rs. 25,000 for ICICI Customers

Joining Fee:

Nil

Welcome Benefits:

Get welcome benefits worth Rs. 1500 plus 3 months Prime membership.

Best Suited For:

This credit card is best suited for frequent Amazon shoppers and those who frequently make online purchases. It offers attractive rewards and benefits specifically tailored for Amazon customers.

Best Feature:

The standout feature of the Amazon Pay ICICI Bank Credit Card is its robust cashback rewards program. Cardholders can earn cashback in the form of Amazon Pay balance on various transactions, including shopping on Amazon, fuel purchases, bill payments, and more. The accumulated cashback can be conveniently used to make purchases on Amazon, providing a seamless and rewarding shopping experience.

Myntra Kotak Credit Card

The Myntra Kotak Credit Card is a co-branded credit card offered by Kotak Mahindra Bank in partnership with Myntra, one of India’s leading fashion e-commerce platforms. This credit card is designed to provide exclusive benefits and rewards to frequent shoppers on Myntra.

Eligibility:

-

- Primary Credit Card holders should be in the age bracket of 18 years to 65 years. Add-on Card holder should be 18 years and above.

- Should be a resident of India.

Joining Fee:

Rs. 500

Welcome Benefits:

Myntra Voucher worth Rs.500 on activation of the card.

Complete 1 transaction worth Rs. 500 or more within 30 day of card issuance to be eligible for the activation benefit.

Myntra voucher will be disbursed to the customer via Email/SMS within 30 days of activation of the card which can be availed to enjoy a discount of Rs. 500 on you Myntra cart.

Best Suited For:

Ideal for individuals who frequently shop for clothing, accessories, and lifestyle products on Myntra, one of India’s leading online fashion retailers.

Best Feature:

Earn accelerated reward points on Myntra and other partner merchants. These points can be redeemed for Myntra vouchers, discounts, and exclusive offers, enhancing your shopping experience.

American Express Membership Rewards® Credit Card

The American Express Membership Rewards® Credit Card is a highly sought-after credit card known for its exceptional benefits and rewards program. With a generous credit limit, this card offers users the flexibility to make their desired purchases while earning valuable points.

Eligibility:

-

-

Annual Income of Rs. 6 Lakhs and above (in case of Self Employed or Salaried).

-

A good credit history and no payment defaults.

-

Joining Fee:

Rs 1,000 (plus applicable taxes)

Welcome Benefits:

Welcome Gift of 4,000 Membership Rewards Points will be applicable on payment of Joining fee and on spending INR 15,000 within first 90 days of Card membership.

Best Suited For:

Individuals who value rewards and benefits, enjoy travel and dining experiences, and seek a flexible redemption program.

Best Feature:

Extensive Membership Rewards Program offering a wide range of redemption options, including flights, hotels, gift cards, and merchandise.

Lifestyle Credit Cards

Lifestyle credit cards cater to the specific needs and preferences of individuals who seek a card that complements their lifestyle choices. These cards often offer rewards and benefits tailored towards popular lifestyle categories such as travel, dining, entertainment, and shopping. With perks like access to exclusive events, discounts, concierge services, and accelerated rewards on specific spending categories, lifestyle credit cards provide a personalized and rewarding experience for those looking to enhance their everyday activities and indulge in their preferred lifestyle pursuits. Here are our top recommendations for the Lifestyle credit cards available in India:

Axis Bank SELECT Credit Card

The Axis Bank SELECT Credit Card is a top pick for individuals seeking an exceptional shopping experience. This card offers exclusive benefits and privileges, making it perfect for those who enjoy indulging in retail therapy. With accelerated rewards on shopping spend, attractive cashback offers, and discounts at partner stores, this credit card enhances your shopping experience while providing value for money.

Eligibility:

-

- Primary cardholder between the age of 18 years and 70 years

- Add-on cardholder should be over 18 years

- Net income of 6,00,000 per annum or more

- Resident and Non-Resident Indian

Joining Fee:

Rs. 3,000 (plus applicable taxes)

Welcome Benefits:

Amazon voucher (worth Rs. 2,000) on making the first transaction within 90 days of card issuance.

Best Suited for:

Individuals who frequently travel and dine out.

Best Feature:

Enjoy complimentary access to domestic and international airport lounges through the Priority Pass program, providing a luxurious and comfortable travel experience.

Axis Bank Privilege Credit Card

Axis Bank Privilege Credit Card is a premium credit card offering a range of exclusive benefits and rewards. Designed for individuals who value personalized services and a luxurious lifestyle, this card comes with an array of privileges.

Eligibility:

-

- Primary cardholder should be between 18 to 70 years of age

- Add-on cardholder should be over 18 years

- Net income of Rs. 6,00,000 per annum

- Resident of India

Joining Fee:

Rs. 1,500

Nil (for priority banking customers)

Welcome Benefits:

12,500 Edge Reward Points on payment of joining fee & 6,250 Edge Reward Points for priority banking customers.

Best Suited for:

Individuals who frequently travel and enjoy lifestyle privileges.

Best Feature:

Enjoy access to domestic and international airport lounges across the world, providing a comfortable and luxurious travel experience.

IDFC FIRST Select Credit Card

The IDFC FIRST Select Credit Card is a premium offering from IDFC FIRST Bank, designed to provide an enhanced and rewarding credit card experience. With its unique features and benefits, this credit card caters to the needs of discerning customers.

Eligibility:

-

- Annual income of ₹ 12 Lacs or more.

- A good credit history.

Joining Fee:

Nil

Welcome Benefits:

-

- Welcome voucher worth ₹500 on spending ₹15,000 or more within 90 days of card generation.

- 5% cashback (up to ₹1000) on the transaction value of first EMI done within 30 days of card generation.

Best Suited For:

-

- Individuals who prefer personalized benefits and services.

- Those who frequently dine out, shop online, and travel.

Best Feature:

Enjoy the dedicated assistance of a Personal Relationship Manager to address your queries, provide customized financial advice, and help with any card-related needs.

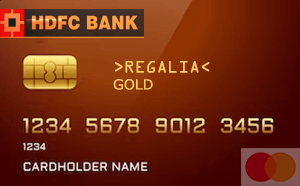

HDFC Bank Regalia Gold Credit Card

HDFC Bank Regalia Gold Credit Card is a prestigious offering from HDFC Bank, catering to the needs of discerning customers. With a focus on luxury and exclusive benefits, this credit card is designed to enhance your lifestyle.

Eligibility:

-

- For Salaried Indian national, Net Monthly Income> Rs 1,00,000

- For Self Employed Indian national, Income: ITR > Rs 12 Lakhs per annum

Joining Fee:

Rs. 2500 plus taxes

Welcome Benefits:

-

- Pay your Joining Membership Fee and get Gift Voucher equivalent to Fee Amount = Rs.2,500.

- Complimentary Club Vistara Silver Tier and MMT Black Elite Membership when you spend Rs. 1 Lakhs and above within 90 days of card issuance.

Best Suited For:

Individuals who frequently travel domestically and internationally.

Best Feature:

The HDFC Bank Regalia Gold Credit Card offers excellent travel benefits, including complimentary airport lounge access, priority pass membership, air accident insurance, and travel insurance coverage. These features make it an ideal choice for frequent travelers.

SBI Prime Credit Card

SBI Prime Credit Card is a premium credit card offered by the State Bank of India (SBI). With its host of features and benefits, it caters to the needs of individuals seeking a rewarding credit card experience.

Eligibility:

-

- Income- For Salaried, Rs. 32,000 per month

For Self Employed, Rs. 32,000 per month (as per ITR)

- Income- For Salaried, Rs. 32,000 per month

Joining Fee:

Rs. 2,999 (plus applicable taxes)

Welcome Benefits:

Welcome e-gift Voucher worth Rs. 3,000 from any of the following brands: Bata/Hush Puppies, Pantaloons, Aditya Birla Fashion, Shoppers Stop and Yatra.com

Best Suited for:

The SBI Prime Credit Card is well-suited for individuals who frequently spend on dining, groceries, movies, and international travel. It offers a range of benefits in these categories.

Best Feature:

The standout feature of the SBI Prime Credit Card is its milestone benefits. Cardholders can earn milestone rewards, such as e-vouchers or bonus points, by reaching specified spending thresholds within a year.

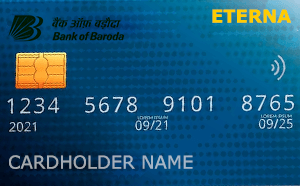

Bank of Baroda Eterna Credit Card

Bank of Baroda Eterna Credit Card is a premium credit card offered by Bank of Baroda. This credit card is designed to provide a host of benefits and privileges to its cardholders. With a focus on lifestyle and travel, the Eterna Credit Card offers attractive rewards and perks.

Eligibility:

-

- Primary cardholder between the age of 21 years and 65 years

- Add-on cardholder should be over 18 years

- Salaried/Self-Employed with an income of ₹ 12 Lakhs per annum or more

Joining Fee:

Rs. 2,499 + GST

Welcome Benefits:

6-month FitPass Pro membership worth Rs. 15,000 and 10,000 bonus reward points.

Best Suited for:

Customers who prioritize exclusive privileges and lifestyle perks.

Best Feature:

Enjoy access to domestic and international airport lounges across the globe, providing a luxurious and comfortable travel experience.

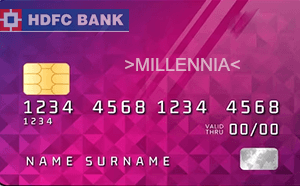

HDFC Bank Millennia Credit Card

HDFC Bank Millennia Credit Card is a popular credit card option offered by HDFC Bank. It caters to the needs and preferences of the millennial generation.

Eligibility:

-

- Gross Monthly Income> ₹35,000

- Salaried or self-employed individuals with a regular income.

- Good credit score.

Joining Fee:

Rs. 1,000 (plus taxes)

Welcome Benefits:

1000 Cash Points (applicable only on payment of membership fee)

Best Suited For:

The HDFC Bank Millennia Credit Card is best suited for young professionals and millennials who enjoy online shopping, dining out, and entertainment.

Best Feature:

The HDFC Bank Millennia Credit Card offers attractive cashback rewards on various online transactions, including shopping, travel bookings, and bill payments. This feature makes it ideal for those who frequently make online purchases or use digital services.

Super Premium Credit Cards

Super premium credit cards are exclusive financial products designed for high-net-worth individuals. These cards offer an array of luxurious benefits and privileges, such as personalized concierge services, access to VIP airport lounges, complimentary hotel stays, and enhanced rewards programs. With higher credit limits and prestigious branding, super premium credit cards cater to the sophisticated lifestyle of affluent cardholders, providing them with unparalleled convenience, prestige, and exceptional customer service. In our opinion, the following credit cards stand out as the best super premium credit cards available in India.

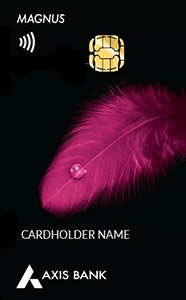

Axis Bank Magnus Credit Card

The Axis Bank Magnus Credit Card is a premium offering that caters to the discerning needs of affluent individuals. With its exclusive benefits and privileges, this card ensures a luxurious experience.

Eligibility:

-

- Primary cardholder between age of 18 years and 70 years.

- Add-on cardholder should be over 18 years.

- Salary of Rs.18 Lakhs per annum or Annual Income Tax Return filed for Rs.18 Lakhs.

Joining fee:

Rs. 10,000 plus taxes

Welcome Benefits:

Choose between one complimentary domestic flight ticket and a Tata CLiQ voucher worth Rs.10000.

Best Suited For:

Individuals who prefer luxury and premium lifestyle experiences.

Best Feature:

Enjoy unlimited access to domestic and international airport lounges, providing a luxurious and comfortable travel experience.

American Express Platinum Credit Card

The American Express Platinum Credit Card is a prestigious and premium credit card offering an array of exclusive benefits and privileges. With a focus on luxury and personalized experiences, this card is designed for individuals who seek unparalleled services and exceptional rewards.

Eligibility:

-

- Salaried or Self-employed

- Minimum Income – Rs. 25 Lakh p.a. for salaried

- Rs. 15 Lakh p.a. for self-employed

Joining fee:

Rs. 60,000 (plus applicable taxes)

Welcome Benefits:

Get stay vouchers worth INR 45,000 from Taj, SeleQtions and Vivanta Hotels on spending INR 50,000 in first 2 months of Cardmembership.

Best Suited For:

Individuals who travel frequently and value luxury experiences.

Best Feature:

Enjoy access to a wide network of airport lounges across the globe, providing a luxurious and relaxing experience before your flights.

HDFC Bank INFINIA Credit Card Metal Edition

The HDFC Bank INFINIA Credit Card Metal Edition is a prestigious credit card designed for individuals seeking unmatched luxury and premium benefits. The card comes with a stunning metal design, symbolizing exclusivity and sophistication. With its metal edition, the HDFC Bank INFINIA Credit Card offers enhanced elegance and style. Beyond its luxurious appearance, the card provides a host of exceptional benefits.

Eligibility:

Membership for the HDFC Bank Infinia Credit Card is By Invite Only.

Joining Fee:

Rs. 12,500 + applicable taxes

Welcome Benefits:

Complimentary Club Marriott membership for a year that offers up to 20% discounts for Dining and Stay across Asia – Pacific region.

Get welcome benefit of 12,500 reward points upon fee realisation and card activation.

Best Suited For:

This premium credit card is best suited for high-income individuals who frequently travel and indulge in luxury experiences. It caters to those who seek exclusive privileges and exceptional benefits.

Best Feature:

The HDFC Bank INFINIA Credit Card comes in a luxurious metal edition, which not only adds to its premium appeal but also enhances the card’s durability and aesthetics. The metal card exudes elegance and reflects the cardholder’s elite status.

Standard Chartered Ultimate Credit Card

The Standard Chartered Ultimate Credit Card is a top-tier credit card offering a range of exclusive benefits and rewards. With this card, cardholders can enjoy a host of privileges designed to enhance their lifestyle and provide exceptional experiences.

Eligibility:

-

- Applicant’s age should be between 21 and 65.

- Applicant should have a stable monthly income.

- Applicant should belong to credit cards sourcing cities/locations of the Bank.

- All applications are subject to credit and other policy checks of the Bank.

Joining Fee:

Rs. 5,000

Welcome Benefits:

Earn 6000 Reward Points* worth Rs. 6000 on payment of joining fee.

Best Suited For:

Individuals who frequently travel or enjoy lifestyle benefits.

Best Feature:

The Standard Chartered Ultimate Credit Card offers an array of travel-related benefits, including airport lounge access, complimentary travel insurance, exclusive hotel privileges, and attractive discounts on flights and hotel bookings.

ICICI Bank Emeralde Credit Card

ICICI Bank Emeralde Credit Card is a prestigious offering from ICICI Bank, one of India’s leading private sector banks. This credit card is designed to cater to the needs of discerning customers who value exclusivity and a luxurious lifestyle.

Eligibility:

-

- ₹ 3,00,000 or above net monthly salary income.

- Annual Income Tax Returns filed- ₹ 30,00,000 or above.

- All existing ICICI Bank Global Private Client customers are eligible to apply for the ICICI Bank Emeralde Credit Card.

Joining Fee:

Rs. 1,000 + Taxes for monthly plan, Rs. 12,000 + taxes for annual plan

Welcome Benefits:

None

Best Suited For:

Individuals looking for a premium credit card with exclusive benefits and privileges.

Best Feature:

Enjoy access to select domestic and international airport lounges, providing a comfortable and luxurious travel experience.

SBI ELITE Credit Card

The SBI ELITE Credit Card is a premium credit card offered by the State Bank of India (SBI), one of India’s leading banks. This card is designed for individuals seeking exclusive privileges and benefits.

Eligibility:

-

- You must be between the ages of 18-70 years.

- The add-on cardholder must be above the age of 15 years.

- A credit score of 750 or above is essential to be eligible for the card.

Joining Fee:

Rs. 4,999 (plus taxes)

Welcome Benefits:

Welcome e- Gift Voucher worth Rs. 5,000

Choose from an array of travel and lifestyle brands : Yatra, Hush Puppies/Bata, Pantaloons, Aditya Birla Fashion and Shoppers Stop.

Best suited for:

Frequent travelers, luxury lifestyle enthusiasts, and individuals who enjoy a wide range of premium benefits and rewards.

Best feature:

Complimentary membership to the Elite Priority Pass Program, providing access to over 1,000 airport lounges worldwide, allowing cardholders to relax and unwind before their flights.

HDFC Bank Diners Club Black Credit Card

The HDFC Bank Diners Club Black Credit Card is a prestigious credit card offered by HDFC Bank. It is designed for individuals who appreciate luxury, travel, and exclusive privileges. With this card, customers gain access to a wide array of benefits that enhance their lifestyle.

Eligibility:

-

- Income – For Salaried Indian national, Net Monthly Income > Rs 1.75 Lakhs per month

- For Self Employed Indian national, ITR > Rs 21 Lakhs per annum for self-employed customers

Joining Fee:

Rs. 10,000/- plus Applicable Taxes

Welcome Benefits:

Complimentary Annual memberships of Club Marriott, Forbes, Amazon Prime, Swiggy One (3 months), MMT BLACK by spending 1.5 lakhs within the first 90 days or upon first year fee realization.

Best suited for:

Frequent travelers, luxury lifestyle enthusiasts, and those who enjoy exclusive privileges and rewards.

Best feature:

Offers an excellent feature called “Unlimited Lounge Access”, cardholders can enjoy complimentary access to airport lounges across the globe, allowing them to relax and unwind in comfort before their flights.

Travel Credit Cards

Travel credit cards are designed specifically for globetrotters and adventure-seekers, offering a range of benefits and rewards that enhance the travel experience. These cards often provide generous sign-up bonuses, earning points or miles for every dollar spent, and exclusive perks such as airport lounge access, travel insurance coverage, and concierge services. With their focus on travel-related rewards and features, travel credit cards are a valuable tool for frequent travelers looking to maximize their rewards and enjoy a seamless journey. Here are our top picks for the best travel credit cards available in India:

Axis Bank Vistara Infinite Credit Card

The Axis Bank Vistara Infinite Credit Card is a premium credit card that is ideal for frequent travelers and Vistara airline enthusiasts. With this card, users can enjoy a host of travel benefits and rewards.

Eligibility:

-

- Primary cardholder should be between 18 to 70 years of age.

- Minimum net income should be Rs. 6,00,000 per annum.

- The applicant should be a Resident of India.

Joining Fee:

Rs. 10,000 (plus applicable taxes)

Welcome Benefits:

One Complimentary Business Class ticket voucher.

Best suited for:

Individuals who frequently travel with Vistara as it offers a range of benefits specifically designed for air travelers.

Who have high monthly spending patterns and can maximize the rewards and benefits offered.

Best feature:

Complimentary domestic flight tickets as a welcome benefit and upon reaching spend milestones. This feature allows cardholders to save significantly on their air travel expenses.

6E Rewards XL – Indigo Kotak Bank Credit Card

The 6E Rewards XL – Indigo Kotak Bank Credit Card is a co-branded credit card offered by Indigo Airlines in partnership with Kotak Bank. This credit card offers numerous benefits to frequent travelers.

Eligibility:

-

- Primary Credit Card holder should be in the age bracket of 21 years to 65 years. Add-on Card holder should be 18 years and above.

- Should be a resident of India.

Joining Fee:

Rs. 2500 (1500 as introductory fee)

Welcome Benefits:

Get a welcome ticket worth Rs. 3,000

Best suited for:

Frequent travelers who prefer IndiGo airlines.

Best feature:

Earn accelerated 6E rewards on IndiGo flight bookings, dining, entertainment, and more. Redeem rewards for IndiGo flights, hotel stays, and other exciting offers.

Air India SBI Signature Credit Card

The Air India SBI Signature Credit Card is a premium credit card designed for frequent travelers and loyal customers of Air India. With a host of benefits and exclusive privileges, this card offers a seamless travel experience.

Eligibility:

-

- You must be an Indian citizen.

- Stable source of income and a good credit history.

Joining Fee:

Rs. 4,999 (plus applicable taxes)

Welcome Benefits:

Get 20,000 Reward points* on payment of your joining fee.

Best Suited For:

Frequent flyers and Air India customers who want to maximize their travel benefits and enjoy exclusive privileges.

Best Feature:

-

- Complimentary membership to the Air India Frequent Flyer Program, allowing cardholders to earn reward points on Air India flights and partner airlines.

- Complimentary domestic airport lounge access at select airports in India.

- Exclusive discounts on airfare, companion tickets, and upgrades with Air India.

IRCTC SBI Card Premier

The IRCTC SBI Card Premier is a popular credit card offered by State Bank of India (SBI) in partnership with the Indian Railway Catering and Tourism Corporation (IRCTC). This credit card is designed for individuals who frequently travel by train and wish to enjoy exclusive benefits and rewards.

Eligibility:

-

- You must be between the ages of 18-60 years.

- Salaried or Self-employed

Joining Fee:

Rs. 1499 + GST

Welcome Benefits:

Get 1500 Reward Points equivalent to INR 1500 on payment of first annual fee (1 Reward Point= ₹ 1).

Best Suited For:

Frequent train travelers who use the IRCTC platform for booking tickets and other related services.

Best Feature:

Accelerated reward points on train ticket bookings through the IRCTC platform, as well as on retail spends, dining, and international transactions. These reward points can be redeemed for train tickets, hotel bookings, air miles, and more.

American Express Platinum Travel Credit Card

The American Express Platinum Travel Credit Card is designed for individuals who frequently travel and seek luxurious travel experiences. With this card, cardholders can enjoy a range of exclusive benefits and privileges, making it an ideal choice for those who value comfort and convenience while on the go.

Eligibility:

-

- Good credit history and no payment defaults.

- Personal annual income of Rs. 6 Lacs or above (for both Salaried, Self Employed)

Joining Fee:

Rs. 3,500 plus applicable taxes.

Welcome Benefits:

10,000 Membership Rewards points* redeemable for Flipkart voucher or Pay with Points option in Amex Travel Online worth Rs. 3,000.

Best suited for:

Individuals who travel frequently, whether for business or leisure. It offers various travel benefits and rewards tailored to enhance the travel experience.

Best feature:

Cardholders can earn travel points on their spending, which can be redeemed for flights, hotel stays, car rentals, and more. Additionally, they enjoy exclusive access to airport lounges, travel insurance coverage, and attractive travel-related offers.

Fuel Credit Cards

Fuel credit cards are specifically designed to provide benefits and rewards for individuals who frequently use their vehicles. These cards offer various incentives, such as cashback or reward points, on fuel purchases at designated gas stations. They often come with additional perks like discounts on maintenance services or car accessories. Fuel credit cards are an excellent choice for individuals looking to save money on their fuel expenses while enjoying additional benefits related to their vehicle usage. Here are some of the best fuel credit cards in India:

ICICI Bank HPCL Super Saver Credit Card

ICICI Bank HPCL Super Saver Credit Card is a popular choice for individuals who frequently use their vehicles and prefer to fuel up at HPCL petrol pumps. With this credit card, you can enjoy attractive benefits and savings on your fuel expenses.

Eligibility:

-

- A minimum annual income of Rs. 3 lakhs.

- The applicant should have a decent credit score.

- Joining Fee:

Rs 500 + Goods and Services Tax (GST)

Welcome Benefits:

2,000 bonus Reward Points on paying the membership fee within 2 months and spending at least Rs. 5,000 within the first 45 days of card issuance; Rs. 100 cashback on HP Pay app on the first fuel purchase of Rs. 1,000 or more.

Best Suited For:

Individuals who frequently use their credit card for fuel purchases.

Best Feature:

Attractive cashback and savings on fuel purchases made at HPCL petrol pumps. Cardholders can earn fuel surcharge waivers and cashback on fuel transactions, making it an excellent choice for frequent travelers and those who rely heavily on their vehicle.

IDFC HPCL First Power Plus Credit Card

The IDFC HPCL First Power Plus Credit Card is a premium credit card offered by IDFC Bank in partnership with HPCL. With this card, customers can enjoy a range of features that make it a valuable addition to their wallet.

Eligibility:

-

- Your credit score must be excellent.

- The annual income should be at least INR 3 lakh.

Joining Fee:

Introductory Offer with ₹0 Joining fee till 30th June 2023

Welcome Benefits:

₹500 cashback on 1st HPCL fuel transaction of ₹500 or above*. If you convert your first transaction into an EMI, you can get a 5% cashback, up to ₹1,000. The card also provides a ₹150 discount on Swiggy orders above ₹500 and a ₹500 discount on ZoomCar rentals. Moreover, you can enjoy discounts of up to 50% on domestic and international rental cars with Eco Rent A Car and Europcar.

Best Suited for:

Individuals who frequently use their credit card for fuel purchases at HPCL petrol pumps.

Best Feature:

Provides attractive fuel benefits, offering significant savings on fuel purchases made at HPCL petrol pumps. The card also offers fuel surcharge waivers, enabling cardholders to save additional money on fuel purchases.

IndianOil Kotak Credit Card

The IndianOil Kotak Credit Card is a sought-after financial tool for individuals who frequently use their vehicles and want to save on fuel expenses.

Eligibility:

-

- Primary Credit Card holders should be in the age bracket of 18 years to 65 years. Add-on Card holder should be 18 years and above.

- Should be a resident of India.

Joining Fee:

INR 449/-

Welcome Benefits:

Get 1000 Reward Points on spending Rs. 500 or more within 30 days of getting the card.

Best Suited for:

People who frequently use their vehicles and require fuel for their daily commute or travel.

Best Feature:

Offers impressive fuel benefits, including fuel surcharge waivers, accelerated reward points on fuel purchases, and attractive discounts at IndianOil outlets. This feature enables cardholders to maximize their savings on fuel expenses and earn rewards simultaneously.

BPCL SBI Credit Card

The BPCL SBI Credit Card is a co-branded credit card that combines the expertise of Bharat Petroleum Corporation Limited (BPCL) and State Bank of India (SBI). This card is designed to cater to the needs of individuals who frequently refuel their vehicles at BPCL petrol pumps.

Eligibility:

-

- You must be between the ages of 18-60 years.

- Salaried or Self-employed.

Joining Fee:

Rs. 499 (plus applicable taxes)

Welcome Benefits:

Get 2,000 Activation Bonus Reward Points worth Rs. 500, Reward Points will be credited after 20 days of the payment of joining fee and the same can be redeemed instantly against fuel purchase at BPCL outlets or at Shop n Smile rewards catalogue.

Best Suited for:

Individuals who frequently fuel up at BPCL petrol pumps and for those who want to earn rewards and save on fuel expenses.

Best Feature:

Offers attractive fuel benefits, including accelerated reward points and fuel surcharge waivers at BPCL outlets. Cardholders can earn bonus reward points on fuel purchases, which can be redeemed for various rewards or used to offset future fuel expenses.

Standard Chartered Super Value Titanium Credit Card

The Standard Chartered Super Value Titanium Credit Card is a highly sought-after credit card that offers an array of benefits. It is designed for individuals who frequently spend on dining, fuel, and utility bills.

Eligibility:

- Applicant’s age should be between 21 and 65 years.

- Minimum age for add-on cardholder is 18 years.

- Minimum monthly income of INR 55,000 is required.

- Applicants should belong to credit card sourcing cities/locations of the Bank.

Joining Fee:

INR 750

Welcome Benefits:

Up to 1,500 cashback on fuel transactions within the first three months.

Best suited for:

Individuals who frequently spend on categories such as dining, fuel, and utility bills. It offers significant cashback and rewards on these categories, making it an ideal choice for those who want to maximize their savings.

Best feature:

Offers generous cashback program, cardholders can earn up to a certain percentage of cashback on their dining, fuel, and utility bill spends, allowing them to save substantially on their everyday expenses.

Movie and Dining Credit Cards

Movie and dining credit cards are specifically tailored to cater to the entertainment and culinary needs of cardholders. These cards often offer exclusive discounts, cashback, or rewards on movie ticket purchases and dining expenditures. With these cards, individuals can enjoy special privileges such as free movie tickets, discounted dining bills, or access to exclusive events. Whether it’s a night out at the movies or a delightful dining experience, movie and dining credit cards provide added value and perks to enhance the overall entertainment and culinary experiences of cardholders. Following are the best movie and dining credit cards in India:

RBL Bank Edition Credit Card

The RBL Bank Edition Credit Card is a versatile financial tool designed to cater to the diverse needs of cardholders. With its customizable card design feature, individuals can personalize their card with a picture of their choice, adding a touch of personalization.

Eligibility:

-

- Minimum age should be 21 years.

- Stable source of Income.

- Have decent credit score.

Joining Fee:

Rs. 2,000 + GST

Welcome Benefits:

Complimentary Zomato pro membership.

Best Suited For:

Individuals who frequently shop online or enjoy dining out. It caters to those who value exclusive benefits, discounts, and rewards in these categories.

Best Feature:

Allows cardholders to personalize their card design with a picture of their choice, providing a unique and personalized touch to their card.

EazyDiner Indusind Bank Credit Card

The EazyDiner IndusInd Bank Credit Card is a sought-after co-branded credit card that caters specifically to food enthusiasts and frequent diners. With its exclusive dining benefits and rewards, this card is designed to enhance the overall dining experience.

Eligibility:

-

- Stable income as a salaried or self-employed.

- Have a decent credit score (750 or above).

Joining Fee:

INR 1999

Welcome Benefits:

-

- Get 2,000 Eazy Points after the joining fee has been successfully paid.

- Enjoy 12 months EazyDiner Prime membership, Unlock more Prime-exclusive benefits like 3X EazyPoints and redeem them for FREE luxury hotel stays & FREE meals.

Best Suited For:

Individuals who enjoy dining out frequently and want to make the most of their dining experiences.

Best Feature:

Offers attractive dining privileges, such as complimentary meals, discounts, and special offers at partner restaurants.

BookMyShow RBL Bank Play Credit Card

The BookMyShow RBL Bank Play Credit Card is a collaboration between BookMyShow, India’s leading online ticketing platform, and RBL Bank. This credit card is specifically designed for movie and entertainment enthusiasts.

Eligibility:

-

- Applicants should be at least 21 years and supplementary card applicants should be a minimum of 18 years.

- Applicants should either be self-employed or salaried with a stable source of income.

Joining Fee:

Rs. 500 + GST

Welcome Benefits:

Enjoy a Rs. 500 discount on BookMyShow on making a purchase within 30 days of Card issuance.

Best suited for:

This credit card is best suited for frequent users of BookMyShow, India’s leading online ticketing platform for movies, events, and entertainment. It is designed to enhance the overall movie and entertainment experience.

Best feature:

Offers Exclusive rewards and benefits for movie lovers. Cardholders can enjoy multiple benefits such as complimentary movie tickets, cashback on movie ticket purchases, discounts on food and beverages at cinemas, and priority access to events and experiences.

PVR Kotak Platinum Credit Card

The PVR Kotak Platinum Credit Card is a premium offering by Kotak Mahindra Bank, designed for movie enthusiasts and frequent visitors to PVR Cinemas.

Eligibility:

-

- A good credit score is necessary.

- Have a steady source of income.

Joining Fee:

Nil

Welcome Benefits:

None

Best suited for:

Movie enthusiasts and frequent PVR Cinemas visitors.

Best feature:

Cardholders can enjoy complimentary access to the PVR Gold Class Lounge once a month. This lounge provides a luxurious and comfortable environment for moviegoers, with amenities like plush seating, personalized services, and a premium movie-watching experience.