What's Inside?

- What are Equity Mutual Funds?

- Features of Equity Funds

- Top Benefits of Equity Funds

- How to choose the right equity fund?

- Types of Equity Funds based upon Sector

- Types of Equity Funds based upon Market Capitalisation

- When to start investing in Equity Funds?

- How to withdraw money from Equity Funds offline?

- How to withdraw money from Equity Funds online?

- Equity Fund Tax Details

- Equity Fund disadvantages

- Investors’ Top mistakes in Equity Fund

What are Equity Mutual Funds?

Equity mutual funds are investment vehicles that pool money from multiple investors and invest primarily in stocks or equities of different companies. These funds are managed by professional fund managers who aim to generate capital appreciation by carefully selecting stocks that they believe will perform well in the market. Equity mutual funds offer investors the opportunity to participate in the growth potential of the stock market, as the fund’s returns are directly linked to the performance of the underlying stocks. These funds provide diversification as they invest in a portfolio of stocks across different sectors and market capitalizations. The risk and returns associated with equity mutual funds are higher compared to other types of mutual funds, making them suitable for investors with a long-term investment horizon and a higher risk appetite. They are popular among individuals looking to achieve long-term financial goals such as wealth creation, retirement planning, and funding higher education or buying a house. It’s important for investors to carefully analyze the fund’s investment strategy, past performance, fund manager expertise, and associated risks before investing in equity mutual funds.

Features of Equity Funds

Diversification: Equity funds provide investors with diversification benefits by investing in a broad range of stocks across different sectors, industries, and regions. Diversification serves to mitigate the risks tied to investing solely in single stocks.

Professional Management: Equity funds are managed by experienced and qualified fund managers who conduct in-depth research and analysis to make investment decisions. These managers aim to identify undervalued stocks or companies with growth potential, aiming to generate maximum returns for the investors.

Access to Stock Market: Equity funds allow individual investors to participate in the stock market without the need for extensive knowledge or expertise in stock selection. The fund manager handles the investment decisions, making it easier for investors to benefit from the potential returns of the stock market.

Liquidity: Equity funds offer high liquidity, allowing investors to buy or sell their shares on any business day at the prevailing net asset value (NAV). This feature provides flexibility and the ability to access funds relatively quickly, compared to other investment options like real estate or fixed deposits.

Risk and Return Potential: Equity funds offer the promise of greater long-term gains when measured against alternative investment categories. Nonetheless, they also entail an elevated degree of risk. The performance of equity funds is subject to market fluctuations and the performance of the underlying stocks in the portfolio.

Different Investment Styles: Equity funds can follow various investment styles, such as growth funds that focus on investing in companies with high growth potential, value funds that seek undervalued stocks, or dividend funds that invest in companies with a history of consistent dividend payments. These different styles cater to the diverse investment preferences of investors.

Flexibility: Equity funds offer flexibility in terms of investment amounts. Investors can start with relatively small investments, making it accessible to a wide range of individuals. Additionally, investors can also choose to invest in equity funds through systematic investment plans (SIPs), allowing periodic investments over time.

Transparency: Equity funds offer consistent reports and disclosures to investors detailing their portfolio compositions, performance metrics, and incurred expenses. This level of openness empowers investors to monitor their investments closely and make well-informed choices.

Top Benefits of Equity Funds

Managed by Professionals: Equity mutual funds are managed by professional fund managers who have the expertise to choose the right investments. This saves investors the time and effort of researching and selecting individual stocks.

Diversification: Investing in an equity mutual fund means investing in a variety of stocks from different companies. This diversification helps to reduce the risk compared to investing in a few individual stocks.

Low Costs: Investing in equity mutual funds comes with regulated expenses, meticulously maintained at minimal levels. This ensures that investors steer clear of hefty fees while participating in the market.

Convenience: Investors have the flexibility to invest a lump sum amount or regularly through Systematic Investment Plans (SIPs) according to their convenience.

Capital Appreciation: If the share prices of the companies in the fund increase, the value of the investment also grows, leading to capital appreciation.

Tax Benefits: Equity Linked Savings Scheme (ELSS) is a type of equity mutual fund that offers tax benefits. Investors have the opportunity to claim tax deductions of a maximum of Rs. 46,800 through Section 80C of the Income Tax Act.

Liquidity: Investors can easily buy or sell their mutual fund units at any time, providing them with liquidity when needed.

Affordability: Starting to invest in equity mutual funds doesn’t require a large amount of money. Investors can start with as little as Rs. 500, making it accessible to a wide range of individuals.

How to choose the right equity fund?

Set a Financial Goal: Start by determining your financial goal. This means setting a specific, measurable, achievable, relevant, and time-bound (SMART) goal. It should be more than just a wish but a clear objective. Your goal will guide you in choosing the right equity fund to invest your money.

Assess Your Risk Profile: Consider your risk tolerance when shortlisting the best equity plans. Some investors prefer more reliable and stable investments, and for them, large-cap funds are suitable. Others may be willing to take higher risks for the potential of higher returns, and they might find medium or small-cap funds more appealing.

Determine the Time Horizon: Identify the time period for which you want to invest your money. This time horizon is connected to your SMART goal. It could be short-term, medium-term, or long-term. Knowing the duration of your investment will help in selecting the appropriate equity fund.

Compare with Benchmark: A benchmark is a reference point used to measure the performance of a fund. By comparing different funds to their respective benchmarks, you can evaluate their performance. This comparison will assist you in choosing the right fund that aligns with your investment goals and expectations.

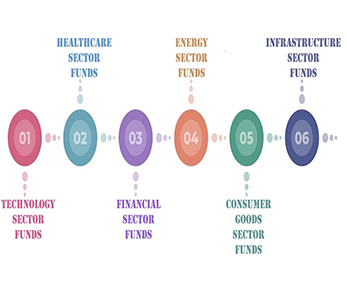

Types of Equity Funds based upon Sector

Equity funds can also be categorized based on the sectors in which they invest. Here are some common types of equity funds based on sector:

Technology Sector Funds: These funds invest primarily in companies operating in the technology sector. They target companies involved in areas such as software development, information technology services, hardware manufacturing, and telecommunications. Technology sector funds aim to benefit from the growth potential of technology-driven industries.

Healthcare Sector Funds: These funds focus on investing in companies within the healthcare sector, including pharmaceuticals, biotechnology, healthcare equipment, and services. Healthcare sector funds aim to capitalize on the increasing demand for healthcare products and services driven by factors such as an aging population and advancements in medical technology.

Financial Sector Funds: These funds concentrate on investing in companies within the financial services sector, including banks, insurance companies, asset management firms, and brokerage houses. Financial sector funds aim to benefit from the growth and profitability of the financial industry.

Energy Sector Funds: These funds primarily invest in companies operating in the energy sector, including oil and gas exploration, production, refining, and distribution. Energy sector funds aim to capitalize on the demand for energy resources and the performance of energy-related companies.

Consumer Goods Sector Funds: These funds target companies in the consumer goods sector, which includes companies manufacturing and selling products such as food, beverages, household products, personal care items, and retail. Consumer goods sector funds aim to benefit from consumer spending and the demand for consumer products.

Infrastructure Sector Funds: These funds invest in companies involved in infrastructure development, including construction, engineering, transportation, and utilities. Infrastructure sector funds aim to benefit from the growth potential of infrastructure projects driven by urbanization, population growth, and government investments.

It’s important to note that sector-specific equity funds tend to have a higher level of concentration and specific risk exposure compared to diversified equity funds.

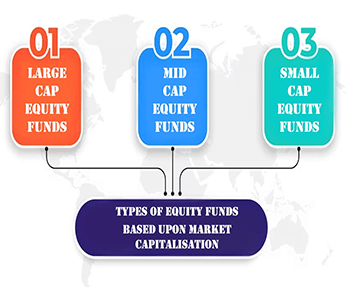

Types of Equity Funds based upon Market Capitalisation

Equity funds are typically classified into three primary categories according to market capitalization.

- Large Cap Equity Funds: These funds primarily invest in companies with large market capitalization. These companies are typically among the top 100 stocks based on market value. Large-cap equity funds focus on well-established and financially stable companies that have a track record of consistent performance. They are considered relatively safer investments compared to mid-cap and small-cap funds, as they are less volatile and have a lower risk of price fluctuations.

- Mid Cap Equity Funds: Mid-cap equity funds allocate their investments to businesses that fall within the realm of medium-sized market capitalization. These companies generally rank between the top 101 and 250 in terms of market value. Mid-cap funds aim to capitalize on the growth potential of these companies, which are often in their expansion phase. They offer a higher risk-reward profile compared to large-cap funds, as they have the potential for greater growth but also carry a higher degree of volatility.

- Small Cap Equity Funds: Small-cap equity funds focus on companies with small market capitalization. These companies usually rank beyond the top 250 in terms of market value. Small-cap funds invest in relatively lesser-known and emerging companies with significant growth potential. They tend to be more volatile and carry higher risk compared to large-cap and mid-cap funds. However, they also offer the possibility of substantial returns for investors willing to take on higher risk.

When to start investing in Equity Funds?

The ideal time to start investing in equity funds depends on various factors, including your financial goals, risk tolerance, and investment horizon. Here are some considerations to help determine when to start investing in equity funds:

Financial Stability: Before venturing into equity funds, it’s important to have a strong financial foundation. Ensure you have built an emergency fund to cover unexpected expenses and have taken care of any high-interest debts. It’s also advisable to have adequate insurance coverage to protect yourself and your dependents.

Long-Term Investment Horizon: Equity funds are primarily suited for long-term investment goals, typically five years or more. The longer your investment horizon, the better your chances of riding out market volatility and benefiting from the potential growth of equities. Starting early allows you to take advantage of the power of compounding and accumulate wealth over time.

Risk Tolerance: Equity funds carry a higher level of risk compared to other investment options. Assess your risk tolerance and determine your comfort level with market fluctuations. If you have a higher risk appetite and can tolerate short-term volatility, you may consider starting your equity fund investments earlier.

Market Conditions: While it’s challenging to time the market, being aware of the overall market conditions can be useful. Investing when markets are down or valuations are attractive can potentially lead to better returns in the long run. However, it’s important to focus on long-term trends rather than trying to predict short-term market movements.

Regular Investing Approach: Instead of trying to time the market, adopting a regular investment approach, such as systematic investment plans (SIPs), can be beneficial. Investing a fixed amount at regular intervals helps in rupee-cost averaging and reduces the impact of market volatility. This approach allows you to start investing in equity funds without the pressure of timing the market perfectly.

Investment Goals: Consider your specific financial goals and investment objectives. If you have long-term goals like retirement planning, education expenses, or wealth creation, starting early in equity funds can provide the potential for higher returns over the long run. Align your investment timeline with your goals and choose funds that suit your objectives.

How to withdraw money from Equity Funds offline?

To withdraw money from equity funds offline, you can follow these general steps:

- Contact the Mutual Fund Company: Get in touch with the mutual fund company or the asset management company (AMC) that manages the equity fund in which you have invested. You can find their contact details on their website or through their customer service helpline.

- Request for Redemption Form: Ask the mutual fund company to send you a redemption form or visit their nearest branch office to collect the form in person. The redemption form is used to initiate the process of withdrawing your money from the equity fund.

- Fill in the Form: Carefully fill in the required details in the redemption form. You will typically need to provide information such as your folio number (unique identifier for your investment), your name, the name of the fund, the number of units or amount you want to redeem, and your bank account details for the transfer of funds.

- Submit the Form: Once you have filled in the redemption form, submit it to the mutual fund company’s branch office or any designated collection center. Make sure to attach any supporting documents that may be required, such as a copy of your identity proof or bank account details.

- Verification and Processing: The mutual fund company will verify the details provided in the redemption form. This may involve checking your investment records and confirming your identity. Once the verification is complete, they will initiate the processing of your redemption request.

- Receive Funds: After the redemption request is processed, the mutual fund company will transfer the redeemed amount to your registered bank account. The timeframe for receiving the funds can vary depending on the mutual fund company and the mode of transfer.

How to withdraw money from Equity Funds online?

To withdraw money from equity funds online, you can follow these general steps:

- Log in to your online investment account: Head over to the platform or company’s website or mobile app where your equity funds are held. Input your login details, including username and password, to gain entry into your account.

- Navigate to the withdrawal section: Once you are logged in, find the section or tab related to withdrawals or redemptions. It is usually located under your investment or portfolio details.

- Select the equity fund and amount: Choose the specific equity fund from which you want to withdraw money. Enter the amount you wish to withdraw or select from available options if provided.

- Choose the withdrawal method: Select the desired withdrawal method, such as bank transfer or electronic funds transfer (EFT). Make sure to provide accurate bank account details if required.

- Review and confirm the transaction: Double-check the details of your withdrawal request, including the equity fund, amount, and withdrawal method. If all appears accurate, proceed with confirming the transaction.

- Wait for processing: The withdrawal request will be processed by the investment platform or company. The time taken for processing may vary depending on the platform and fund.

- Receive the funds: Once the withdrawal request is processed, the money will be transferred to your designated bank account. It could require several business days before the funds appear in your account.

Equity Fund Tax Details

Equity funds in India are subject to certain tax regulations. Here are the tax details related to equity funds:

Long-Term Capital Gains (LTCG) Tax: If you hold equity funds for more than one year, the gains arising from the sale of such funds are considered long-term capital gains. As per the current tax regulations in India, long-term capital gains from equity funds are taxable at a rate of 10% if the gains exceed Rs. 1 lakh in a financial year. However, gains made until January 31, 2018, are grandfathered and not subject to LTCG tax.

Short-Term Capital Gains (STCG) Tax: If you sell equity funds within one year of holding them, the gains are treated as short-term capital gains. Short-term capital gains from equity funds are taxable at a rate of 15% plus applicable surcharge and cess.

Dividend Distribution Tax (DDT): In the case of equity mutual funds, dividends are subject to a Dividend Distribution Tax (DDT) before being distributed to investors. However, the Finance Act 2020 introduced a new tax regime where dividends received from equity funds are taxable in the hands of the investor at their applicable slab rate.

Securities Transaction Tax (STT): When you buy or sell equity funds, you are required to pay Securities Transaction Tax (STT) at the time of sale. The rate of STT is currently 0.001% of the transaction value.

Indexation Benefit: Equity funds do not offer indexation benefit for tax purposes. Indexation is a method of adjusting the cost of acquisition for inflation when calculating capital gains tax on debt-oriented investments.

Equity Fund disadvantages

While equity funds can offer significant growth potential, there are a few disadvantages to consider:

Market Volatility: Equity funds are exposed to market fluctuations, which can lead to periods of volatility. The value of your investment can go up and down, and there is a risk of losing some or all of your invested capital during market downturns.

Risk of Loss: Equity funds carry a higher level of risk compared to other investment options such as fixed-income instruments. The performance of equity funds is directly linked to the performance of the stock market, which can be unpredictable and subject to various factors.

Lack of Guaranteed Returns: Unlike fixed-income investments, such as bonds or fixed deposits, equity funds do not offer guaranteed returns. The returns generated by equity funds are dependent on the performance of the underlying stocks in the portfolio.

Long-Term Investment Horizon: Equity funds are generally considered suitable for long-term investment horizons due to their potential for higher returns. If you have a short-term investment goal, such as needing the funds within a few years, equity funds may not be the most appropriate choice.

Investor Knowledge and Expertise: Investing in equity funds requires some level of knowledge and understanding of the stock market. It’s important to conduct research, analyze fund performance, and stay informed about market trends. Lack of knowledge and expertise can lead to poor investment decisions.

Management Risk: Equity funds are managed by fund managers who make investment decisions on behalf of the investors. The performance of the fund is influenced by the skills and expertise of the fund manager. If the fund manager underperforms or makes poor investment choices, it can negatively impact the returns of the fund.

Costs and Fees: Equity funds may have various fees associated with them, such as expense ratios, transaction fees, and exit loads. These costs can eat into your overall returns and reduce the net gains from your investment.

Investors’ Top mistakes in Equity Fund

Investing without a clear goal: Before you start investing, it’s important to have a specific and achievable goal in mind. This will help you understand how much risk you’re comfortable with and choose the right funds that align with your needs.

Making hasty decisions: Avoid making decisions based on short-term market trends. Stick to your goals even when the market is doing well or poorly.

Relying solely on NAV: Don’t just consider the Net Asset Value (NAV) of a fund when deciding to invest. Other factors like the fund’s management decisions and the companies it invests in also impact its performance.

Forgetting to review: Regularly review the performance of your funds to ensure they are still meeting your expectations. Ignoring this can result in potential losses.

Investing in too many funds: Having too many funds in your portfolio can dilute your returns, especially if some of them are underperforming. It’s better to focus on a few well-performing funds rather than spreading your investments too thin.