What's Inside?

What is SSY (Sukanya Samriddhi Yojana)?

If you’re a parent concerned about your daughter’s education and marriage, you should consider enrolling in the Sukanya Samriddhi Yojana (SSY), a government scheme. It was launched by Prime Minister Narendra Modi in 2015 as part of the “Beti Bachao, Beti Padhao” campaign.

The SSY scheme aims to support the education of girls and address the declining sex ratio in India. It offers monetary support to parents or guardians who have a daughter. Under this scheme, parents need to deposit a minimum of Rs. 250 and a maximum of Rs. 1.5 lakh per year in their daughter’s Sukanya Samriddhi Account.

The account remains active for 21 years starting from its opening date or until the girl reaches 18 and gets married, whichever comes first. Only a 15-year commitment is needed for contributions. Even if no further deposits are made, the account will continue to earn interest until maturity.

To estimate the total savings you can accumulate for your daughter, you can use the SSY Calculator. It’s crucial to understand that the benefits of the SSY scheme are available only until your daughter turns 10 years old. Her 9th birthday will be the last opportunity to enroll her in the scheme.

Benefits of Sukanya Samriddhi Yojana

The advantages offered by the Sukanya Samriddhi Yojana (SSY) serve as compelling reasons to consider investing in this scheme for the future financial well-being of your daughter. It will help you overcome worries about the financial expenses related to your girl child. Here are the advantages:

- You have the option to start a Sukanya Samriddhi Account (SSA) either at a nearby post office or a private or public bank.

- SSY allows you to invest money either in lump sums or at a reduced rate. There’s flexibility with the number of deposits; you can add funds monthly, quarterly, or whenever you’re able.

- When your daughter turns 18 and needs money for education or marriage, you can withdraw up to 50% of the deposit.

- The Sukanya Samriddhi Yojana requires contributions to the account for 14 years from its opening. Yet, the account only reaches maturity once your daughter turns 21. After the initial 14 years, it keeps accumulating interest until she reaches 21 at the predetermined rate.

- You need to deposit a minimum of Rs. 250 and a maximum of Rs. 1.50 lakhs annually in the Suraksha Samriddhi Account (SSA).

- If you forget to deposit the minimum amount in the SSA for a year, your account will be closed. However, you can revive the account by paying a penalty fee of Rs. 50 along with the missed deposit.

- Premature withdrawal is allowed in cases of marriage, illness, education, or other special circumstances.

- Sukanya Samriddhi Yojana provides tax advantages through Section 80C of the Income Tax Act, 1961, allowing for a maximum tax exemption of Rs. 1,50,000.

- When your daughter reaches 21, you have the option to end the scheme, and at that point, the full maturity sum will be handed over to her.

- You have the option to create separate accounts for two daughters who are both under the age of 10. In the case of twins or triplets, you can open a third account by providing proof of their multiple births.

- The SSA can be transferred anywhere in the country if your daughter is shifting from one place to another.

- The scheme offers a higher interest rate compared to other similar savings schemes. The current interest rate is 8.0% for the period from April 1, 2023, to June 30, 2023. Every three months, the interest rate undergoes a review and potential adjustment.

Eligibility for SSY (Sukanya Samriddhi Yojana)

The Sukanya Samriddhi Yojana (SSY) stands out as an excellent investment opportunity in India, yet its accessibility isn’t universal due to specific eligibility criteria. Here are the eligibility criteria:

For the Girl Child:

- Every young female should hold Indian citizenship.

- The Sukanya Samriddhi Yojana exclusively offers benefits to girls. It is exclusively for them.

- A girl must be under ten years old to open an account, but there’s a one-year allowance after she reaches ten to still qualify.

- Proof of age for the girl child needs to be provided when applying for the scheme.

For the Operators:

- Only individuals who are either the legal guardians or biological parents are eligible to initiate account openings for their daughters.

- A legal guardian or parent can open a maximum of two accounts for their girl children. In cases of twins or triplets, each individual is eligible to open up to three accounts.

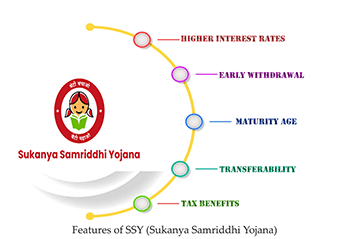

Features of SSY (Sukanya Samriddhi Yojana)

Before investing in any scheme, it’s important to understand its features. The Sukanya Samriddhi Yojana (SSY) presents a range of distinctive features:

Higher interest rates: The Sukanya Samriddhi Yojana (SSY) stands out as India’s premier savings scheme due to its provision of elevated interest rates for deposited funds.

Age limit: You can open an SSY for your daughter anytime from her birth until she turns 10 years old.

Minimum annual deposit: Each year, ensure a minimum deposit of Rs. 250 to maintain your account. Failure to meet this requirement incurs a Rs. 50 penalty to sustain account activity.

Maximum annual deposit: Each year, you’re permitted to deposit a maximum of Rs. 1.5 lakhs into the SSY.

One account per girl child: You can only open one SSY account for each girl child.

Account control: Once the young woman reaches 18 years of age, she will gain authority over the account.

Early withdrawal: There are certain conditions under which early withdrawal or premature closure of the account is allowed.

Maturity age: The SSY account matures when the girl child reaches 21 years of age from the date of opening the account.

Tax benefits: The Senior Citizen Savings Scheme (SSY) provides tax advantages according to Section 80C of the Income Tax Act of 1961. It allows for a maximum tax exemption of Rs. 1,50,000.

Transferability: If the account holder relocates within the country, they’re able to shift their SSY account from one branch to another without any hassle.

How to open Sukanya Samriddhi Account?

The Sukanya Samriddhi Yojana (SSY) is a government scheme that encourages girls’ education and provides financial support to parents or guardians of girl children. Here is a guide to opening an account:

- Visit an authorized bank branch or post office and obtain the SSY account opening form.

- Fill out the form and provide the required documents, including the girl child’s birth certificate, identification proof, and address proof of the parents or guardians.

- Keep the necessary documents ready along with photographs.

- Deposit a minimum of Rs. 250 and a maximum of Rs. 1.5 lakhs into the account.

- Once the account is opened, you can set up standing instructions for automatic credit to the account through internet banking or at the bank branch.

Remember, the minimum amount of Rs. 250 must be deposited every year. Failure to do so will result in the account being considered “account by default.” To keep the account active, a fee of Rs. 50 is required for its reinstatement.

The SSY account has a tenure of 21 years from the opening date, and deposits can be made only until the girl child reaches 15 years of age. After that, no further investments are required. To move the account to any location within India, you must present documentation confirming the relocation. If proof is not provided, there will be a Rs. 100 fee for the transfer. There are no charges for transferring the account.

Several banks offer the SSY, including Allahabad Bank, Andhra Bank, Axis Bank, Bank of Baroda, Bank of India, Canara Bank, ICICI Bank, State Bank of India, and more.

Documents needed to open SSY account

The Sukanya Samriddhi Yojana (SSY) serves as a government initiative aimed at assisting parents with girl children financially. Through this scheme, parents can establish a unique account named the Samriddhi Account (SSA) for their daughters, albeit with a restriction that it can only be opened until the child reaches 10 years of age.

The account can be opened for girl children by either their legal guardians or biological parents. To open an SSA, you need to gather a few important documents:

- You can get an SSA opening form easily from a post office or bank branch that is authorized to provide this service.

- It is mandatory to have the girl child’s birth certificate.

- To open an account, you must present one form of identification from this list: a Driving License, Ration Card, Aadhaar Card, or Pan Card belonging to the account holder.

- To open a Sukanya Samriddhi Account (SSA), you must furnish one address proof among these choices: electricity bill, passport, driver’s license, ration card, or telephone bill belonging to the individual initiating the account.

- You must also provide photos in addition to the documents mentioned earlier.

SSY early withdrawal/ premature closure

The regulations for early withdrawals from the Sukanya Samriddhi Account (SSA) specify that funds can typically only be accessed once your daughter reaches the age of 21. But there are some special situations where you can close the account early:

- If the account holder dies, the account will be closed and the money will be given to the person named as the nominee or the guardian.

- In different scenarios, you’re allowed to seek early closure of the account once 5 years have elapsed since its inception. However, such a request is permissible solely in dire circumstances, specifically when the funds are urgently required for life-threatening medical purposes.

You can take out up to 50% of the money in the account early for two reasons:

- To finance your daughter’s further education, be it college or any desired course post her school studies.

- To cover the costs of her wedding.