What's Inside?

- What is Debt Mutual Fund?

- Features of Debt Funds

- Benefits of Debt Funds

- Types of Debt Funds

- Types of Debt Funds (Table form)

- How to Choose the Right Debt Fund?

- When Should I Start Investing in Debt Funds?

- How to withdraw money from Debt Funds online?

- How to withdraw money from Debt Funds offline?

- Debt Funds Indexation calculation

- Debt Funds Tax Details

- Disadvantages of investing in Debt Funds

- Top mistakes to avoid while investing in Debt Funds

What is Debt Mutual Fund?

A debt mutual fund is a type of investment fund that primarily invests in fixed-income securities such as government bonds, corporate bonds, treasury bills, and money market instruments. It operates by pooling money from various investors and deploying it in a diversified portfolio of debt instruments with varying maturities and credit ratings. The objective of a debt mutual fund is to generate stable income and preserve capital by investing in relatively safer fixed-income securities. These funds are managed by professional fund managers who make investment decisions based on market conditions, interest rate movements, credit quality, and other relevant factors. Debt mutual funds offer investors the opportunity to earn regular interest income and benefit from potential capital appreciation while maintaining a relatively lower level of risk compared to equity investments.

Features of Debt Funds

Here are some key features of debt funds:

Fixed-Income Investments: Debt funds invest in fixed-income securities, which are generally considered less volatile than equities. These securities offer regular interest payments and return the principal amount upon maturity.

Diversification: Debt funds provide diversification by investing in a variety of debt instruments issued by different entities such as governments, corporations, and financial institutions. This diversification helps in spreading the risk across multiple borrowers.

Different Investment Strategies: Debt funds offer various investment strategies to cater to different risk and return preferences. Some examples include government bond funds, corporate bond funds, short-term funds, long-term funds, and liquid funds. Each strategy focuses on specific types of debt instruments.

Risk and Return Profile: Debt funds typically offer lower risk compared to equity funds, but the returns are also relatively lower. The risk and return profile of debt funds vary depending on factors such as the credit quality of the underlying securities, interest rate movements, and fund management strategies.

Credit Quality: Debt funds invest in securities with varying credit ratings. Higher-rated securities are considered less risky, but they also tend to offer lower returns. Lower-rated securities carry higher risk but may offer higher potential returns.

Liquidity: Debt funds provide liquidity to investors by allowing them to buy or sell units on any business day. However, the liquidity can vary depending on the type of debt fund. Liquid funds generally offer high liquidity, while long-term debt funds may have restrictions on withdrawals.

Income Generation: Debt funds generate income through interest payments received from the underlying securities. Investors can choose between regular dividend payouts or growth options where the income is reinvested in the fund.

Tax Efficiency: Debt funds offer certain tax advantages. For example, long-term capital gains on debt funds held for more than three years are taxed at a lower rate compared to short-term gains. However, it’s important to consult with a tax advisor for specific details based on your jurisdiction.

Professional Management: Debt funds are managed by professional fund managers who analyze market conditions, interest rate movements, credit ratings, and other factors to make informed investment decisions on behalf of the investors.

Regulatory Oversight: Debt funds are regulated by the respective financial authorities in each country. These regulations aim to protect the interests of investors and ensure transparency in fund operations.

Benefits of Debt Funds

Debt funds offer several benefits to investors. Here are some key advantages of investing in debt funds:

Regular Income: Debt funds primarily focus on generating regular income for investors through interest payments received from the underlying fixed-income securities. This makes them suitable for individuals who seek a steady income stream, such as retirees or those looking for income distribution.

Lower Risk: Compared to equity investments, debt funds typically carry lower levels of risk. Fixed-income securities have a predetermined interest rate and maturity date, which provides more certainty about the returns and helps in preserving capital. However, it’s important to note that different debt funds may have varying risk profiles based on the credit quality of the underlying securities.

Diversification: Debt funds offer diversification benefits by investing in a range of debt instruments issued by different entities. This diversification helps in spreading the risk across multiple borrowers and reduces the impact of a default by any single issuer. It also allows investors to gain exposure to a variety of sectors, credit ratings, and maturities.

Professional Management: Debt funds are managed by experienced fund managers who have expertise in analyzing credit risk, interest rate movements, and market conditions. Their active management can help in identifying attractive investment opportunities, adjusting the portfolio to changing market conditions, and optimizing the risk-return trade-off.

Liquidity: Debt funds provide liquidity to investors, allowing them to buy or sell units on any business day at the prevailing Net Asset Value (NAV). This makes it convenient for investors to access their invested capital when needed, although some debt funds may have restrictions on withdrawals, particularly long-term funds.

Flexibility: Debt funds offer a wide range of investment options catering to different risk preferences, investment horizons, and income requirements. Investors can choose from various categories such as government bond funds, corporate bond funds, short-term funds, and long-term funds, based on their specific goals and risk appetite.

Tax Efficiency: Debt funds can provide certain tax advantages. For example, long-term capital gains on debt funds held for more than three years may be taxed at a lower rate compared to short-term gains. Additionally, debt funds may offer indexation benefits, which adjust the purchase price for inflation, reducing the taxable gains. However, it’s important to consult with a tax advisor to understand the tax implications based on your jurisdiction.

Transparency: Debt funds are subject to regulatory oversight, which ensures transparency in their operations. Fund managers are required to disclose information about the portfolio composition, investment strategy, and performance on a regular basis. This helps investors make informed decisions and assess the risk associated with the fund.

Accessibility: Debt funds provide access to a wide range of fixed-income securities that may not be easily accessible to individual investors. Through debt funds, investors can gain exposure to government bonds, corporate bonds, treasury bills, and other debt instruments, which may have high minimum investment requirements when investing directly.

Lower Transaction Costs: Investing in debt funds can be cost-effective compared to directly purchasing individual bonds. Debt funds benefit from economies of scale as they pool investments from multiple investors, enabling them to negotiate better pricing on bonds and reduce transaction costs.

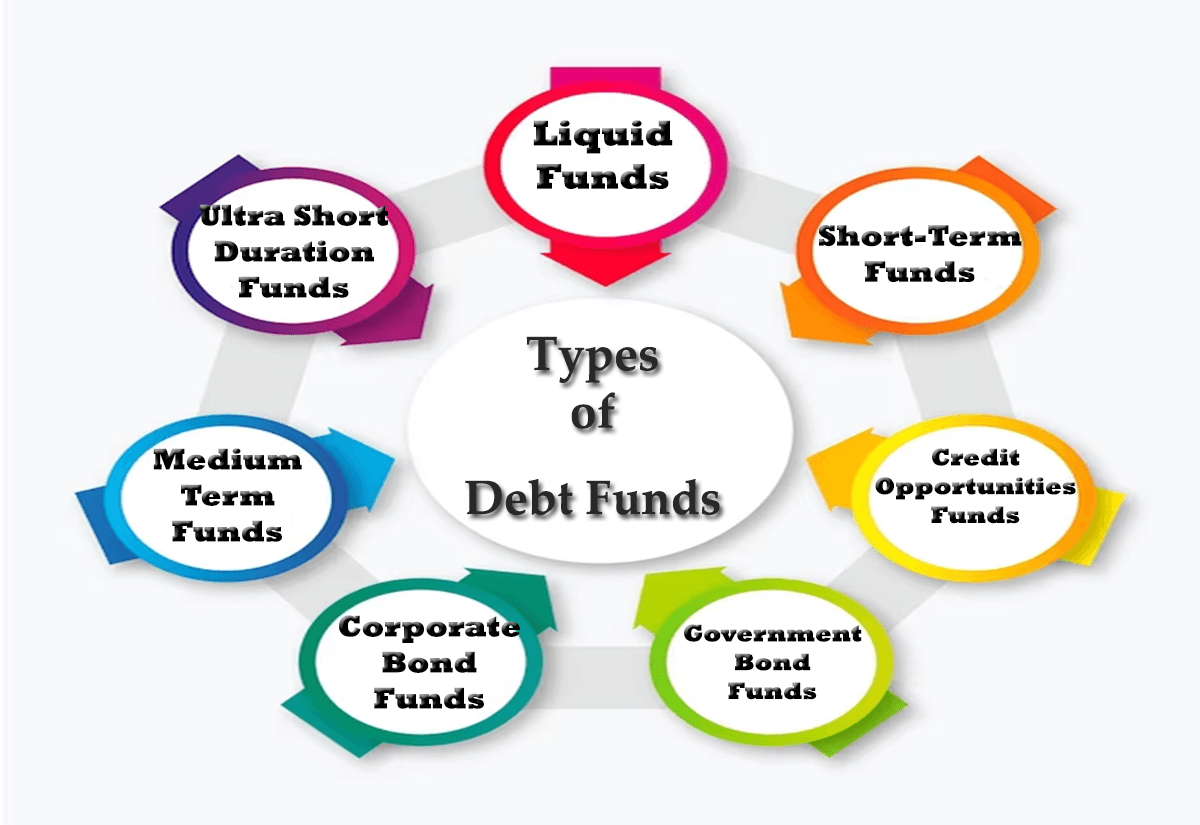

Types of Debt Funds

There are several types of debt funds available to investors, each with its own investment objective and risk profile. Below are various typical categories of debt funds:

- Liquid Funds: These funds invest in short-term debt instruments with a maturity of up to 91 days. They aim to provide high liquidity and stable returns while preserving capital. Liquid funds are suitable for investors looking to park their surplus funds for a short period and earn relatively better returns compared to traditional savings accounts.

- Ultra Short Duration Funds: Ultra short duration funds invest in debt instruments with a slightly longer maturity than liquid funds, typically up to 6 months. They aim to generate stable returns with relatively low interest rate risk. These funds are suitable for investors with a short-term investment horizon and a moderate risk appetite.

- Short-Term Funds: Short-term funds invest in debt instruments with a maturity of 1-3 years. They aim to provide stable income and capital appreciation while managing interest rate risks. These funds are suitable for investors looking for a balance between income generation and capital preservation over a short to medium-term investment horizon.

- Medium-Term Funds: Medium-term funds invest in debt instruments with a maturity of 3-5 years. They aim to generate income and potential capital appreciation over a medium-term investment horizon. These funds are suitable for investors with a relatively longer investment horizon and a moderate risk tolerance.

- Corporate Bond Funds: Corporate bond funds primarily invest in debt instruments issued by corporations. These funds may focus on investment-grade corporate bonds or may have exposure to lower-rated or high-yield corporate bonds. The risk and return profile of corporate bond funds can vary based on the credit quality of the underlying corporate issuers.

- Government Bond Funds: Government bond funds invest in debt securities issued by the government, such as treasury bills and government bonds. These funds provide a relatively safer investment option as they are backed by the government. Government bond funds may focus on short-term, long-term, or a combination of government securities.

- Dynamic Bond Funds: Dynamic bond funds have the flexibility to invest across various debt instruments with different maturities and credit ratings based on the fund manager’s view of interest rates and market conditions. These funds aim to generate optimal returns by actively managing the portfolio duration and credit exposure.

- Credit Opportunities Funds: Credit opportunities funds primarily invest in lower-rated debt instruments or distressed securities. These funds carry higher credit risk but also offer the potential for higher returns. Credit opportunities funds are suitable for investors with a higher risk appetite seeking to capitalize on opportunities in the credit market.

- Gilt Funds: Gilt funds invest in government securities, mainly treasury bills and government bonds. These funds focus on preserving capital and generating income by investing in securities with no credit risk. Gilt funds are suitable for conservative investors looking for low-risk investments.

Types of Debt Funds (Table form)

Below are various categories of debt funds frequently encountered:

| Type of Debt Fund | Description |

|---|---|

| Liquid Funds | Invest in short-term debt instruments with maturity up to 91 days. They provide high liquidity and stability. |

| Ultra Short Duration | Invest in debt instruments with a slightly longer maturity than liquid funds, typically between 3 to 6 months. Provide a balance between liquidity and higher returns. |

| Short Duration | Invest in debt instruments with a duration of 1 to 3 years. Aim for stable returns while managing interest rate risk. |

| Medium Duration | Invest in debt instruments with a duration of 3 to 4 years. Balance higher returns with moderate interest rate risk. |

| Long Duration | Invest in debt instruments with a duration of over 7 years. Ideal for individuals seeking to invest for an extended period. |

| Dynamic Bond | Adjust the portfolio duration based on interest rate expectations. Provides flexibility to capitalize on changing market conditions. |

| Corporate Bond | Invest in corporate bonds issued by companies. Carry credit risk, but can offer higher returns compared to government securities. |

| Government Securities | Invest in debt instruments issued by the government. Considered low risk due to sovereign backing, but provide relatively lower returns. |

| Credit Opportunities | Invest in debt instruments across various credit ratings. Aim to generate higher returns by identifying creditworthy opportunities. |

| Income Funds | Invest in a mix of debt instruments, including government securities and corporate bonds. Focus on generating regular income. |

How to Choose the Right Debt Fund?

Selecting the appropriate debt fund demands meticulous evaluation of your investment goals, willingness to take risks, and pertinent variables. Here are some key steps to help you select the appropriate debt fund:

Determine Investment Objectives: Clearly define your investment goals and time horizon. Are you seeking regular income, capital appreciation, or a combination of both? Are you aiming for short-term gains or looking towards the distant future for your investments? Knowing your goals will assist in pinpointing the most suitable choices.

Assess Risk Tolerance: Evaluate your risk tolerance, which refers to your ability to withstand fluctuations in the value of your investments. Consider factors such as your age, financial situation, and comfort level with volatility. Different debt funds carry varying levels of risk, so choose one that aligns with your risk tolerance.

Consider Fund Categories: Understand the different categories of debt funds available, such as liquid funds, short-term funds, corporate bond funds, etc. Each category has its own risk and return characteristics. Evaluate which category suits your investment objectives and risk profile.

Review Credit Quality: Examine the credit quality of the debt funds you are considering. Credit quality refers to the credit ratings of the underlying debt instruments held by the fund. Higher-rated securities typically offer lower yields but carry lower credit risk, while lower-rated securities may offer higher yields but carry higher credit risk. Assess your comfort level with credit risk and choose a fund with suitable credit quality.

Analyze Past Performance: Evaluate the historical performance of the debt funds you are interested in. Seek out sustained effectiveness across various market fluctuations. However, past performance does not guarantee future results, so use it as one of the factors in your decision-making process.

Fund Manager’s Expertise: Consider the track record and expertise of the fund manager. A skilled and experienced fund manager can make a significant difference in the performance and management of the fund. Look for fund managers with a proven track record in managing debt funds.

Expense Ratio: Compare the expense ratios of different debt funds. The expense ratio represents the annual cost of managing the fund and is deducted from the fund’s returns. Reducing expense ratios can enhance your investment gains in the long run.

Fund House Reputation: Assess the reputation and credibility of the fund house managing the debt fund. Look for fund houses with a strong presence, good governance practices, and a history of providing consistent investor services.

Read Scheme Documents: Carefully read the scheme documents, including the fund’s prospectus, fact sheet, and other relevant disclosures. Understand the investment strategy, risk factors, costs, and other important details of the debt fund.

Seek Professional Advice: Consider consulting with a financial advisor or investment professional who can provide personalized guidance based on your specific financial situation, investment goals, and risk tolerance.

When Should I Start Investing in Debt Funds?

The decision of when to start investing in debt funds depends on your individual financial situation, investment goals, and risk tolerance. Here are some considerations to help you determine when to begin investing in debt funds:

Investment Goals: Evaluate your investment objectives and the duration you plan to hold your investments. If your goals are short-term (1-3 years), such as saving for a down payment on a house or funding a vacation, debt funds can be a suitable option due to their relatively lower risk and potential for income generation. For long-term goals (5 years or more), a combination of debt and equity investments may be more appropriate to balance risk and potential returns.

Emergency Fund: Before investing in debt funds, it’s important to establish an emergency fund. An emergency fund serves as a safety net, offering financial support to tackle unforeseen expenses or sudden drops in income. Aim to accumulate three to six months’ worth of living expenses in a liquid and easily accessible form, such as a savings account or liquid fund, before considering debt fund investments.

Risk Tolerance: Assess your risk tolerance and comfort level with market fluctuations. Debt funds generally carry lower risk compared to equity investments, but they are not risk-free. If you have a low-risk tolerance and prefer stability, debt funds can be a suitable starting point for your investment journey.

Existing Investments: Evaluate your existing investment portfolio. If you already have a diversified portfolio with a significant allocation to equity or other high-risk assets, adding debt funds can help in diversifying your investment holdings and reducing overall portfolio risk.

Interest Rate Outlook: Consider the prevailing interest rate environment. Debt funds are sensitive to interest rate movements, and changes in interest rates can impact their performance. If you believe that interest rates are likely to decrease or remain stable, it may be a favorable time to invest in debt funds. Conversely, if interest rates are expected to rise, it could impact the returns of existing debt funds.

Market Timing: It is challenging to time the market perfectly. Instead of trying to time your entry into debt funds based on short-term market movements, it is generally recommended to adopt a disciplined approach and invest consistently over time, known as systematic investment. This helps in reducing the impact of short-term market fluctuations and allows you to benefit from rupee-cost averaging.

Financial Stability: Ensure that you have a stable financial foundation before investing in debt funds. This includes having a steady source of income, managing your debts responsibly, and addressing any immediate financial needs or obligations. It’s important to have a comprehensive financial plan in place and prioritize your financial well-being before considering investments.

Professional Guidance: Consider seeking the advice of a financial advisor who can provide personalized guidance based on your specific financial situation, investment goals, and risk tolerance. A financial advisor can help you assess the suitability of debt funds in your overall investment strategy and provide recommendations aligned with your needs.

How to withdraw money from Debt Funds online?

To withdraw money from debt funds online, you typically need to follow these steps:

- Login to Your Investment Account: Access the online investment platform or portal provided by the fund house or your investment intermediary (such as a mutual fund distributor or online investment platform). Make sure you have your login details prepared.

- Navigate to the Redemption Section: Once logged in, navigate to the appropriate section or tab that allows you to manage your investments or perform transactions. Look for options related to redemption or withdrawal.

- Select the Debt Fund and Redemption Amount: Choose the specific debt fund from which you want to withdraw money. Enter the redemption amount you wish to withdraw. Keep in mind any minimum redemption amount requirements specified by the fund.

- Review and Confirm Details: Review the transaction details, including the redemption amount, associated charges (if any), and the bank account linked for the transfer of funds. Make sure that the information provided is both accurate and current.

- Authenticate the Transaction: Follow the online prompts to authenticate the redemption transaction. This may involve providing additional security information or using two-factor authentication methods, such as One-Time Passwords (OTP) sent to your registered mobile number.

- Submit the Redemption Request: Once you have reviewed and confirmed all the details, submit the redemption request through the online platform. The system may provide you with a transaction reference number or confirmation message for future reference.

- Await Confirmation and Transfer: After submitting the redemption request, the fund house will process the transaction. You will receive a confirmation email or message indicating that your request has been received and is being processed. The redemption proceeds will be transferred to your registered bank account within the specified timeframe, usually a few business days.

It’s important to note that the specific steps and user interface for online redemptions may vary between different investment platforms and fund houses.

How to withdraw money from Debt Funds offline?

To withdraw money from debt funds offline, you typically need to follow these steps:

- Contact the Fund House: Get in touch with the customer service or investor relations department of the debt fund’s respective fund house. You can find their contact details on the fund’s website or in the scheme documents.

- Request Redemption Form: Request a physical redemption form from the fund house. They may send it to you via mail or email, or you may need to download it from their website.

- Fill in the Redemption Form: Fill out the redemption form with the necessary details. This usually includes your personal information, fund account number, the amount you wish to withdraw, and any specific instructions you may have.

- Attach Supporting Documents: Some fund houses may require additional documents to process your withdrawal, such as a copy of your identity proof (e.g., PAN card, Aadhaar card) and bank account details where you want the redemption proceeds to be transferred.

- Submit the Form: Once you have completed the redemption form and attached any required documents, send it back to the fund house through the designated method specified by them. This could be by mail or in person at their registered office or investor service center.

- Verification and Processing: The fund house will verify the redemption request and process it accordingly. This may involve confirming the details provided, ensuring compliance with any lock-in periods or exit loads applicable, and initiating the transfer of the redemption proceeds to your registered bank account.

- Await Confirmation and Transfer: Once the redemption request is processed, you will receive a confirmation from the fund house. The redemption proceeds will be transferred to your registered bank account as per the timeline specified by the fund house, which can vary from a few business days to a week or more.

It’s important to note that the specific procedures and requirements for offline withdrawals may vary between different fund houses.

Debt Funds Indexation calculation

When you sell debt mutual funds, you may have to pay taxes on the profit you make. The tax is called Long Term Capital Gains (LTCG) and it applies to debt mutual funds that have been held for 36 months or more.

To calculate the tax amount, an indexation method is used. Indexation takes into account the effect of inflation on the cost of the investment. It helps adjust the purchase price of the mutual funds to its current value, considering the impact of inflation over the holding period.

Here’s a simple example to understand how indexation works. Let’s say you bought debt mutual funds for Rs. 10,000 in the financial year 2011-12 and sold them in the financial year 2015-16 for Rs. 15,000. Without indexation, you would have to pay taxes on the entire profit of Rs. 5,000 (15,000 – 10,000).

However, with indexation, the cost price is adjusted for inflation. The inflation-adjusted cost price is calculated using the Cost Inflation Index (CII), which is provided by the government. In this example, let’s assume the CII for the year of sale is 254 and the CII for the year of purchase is 200. Using these values, the inflation-adjusted cost price would be Rs. 12,700 (10,000 * (254/200)).

Therefore, the LTCG tax is applicable only on the difference between the selling price and the inflation-adjusted cost price, which is Rs. 2,300 (15,000 – 12,700).

The benefit of indexation is greater when the holding period is longer. If you hold debt funds for more than 5 years, the LTCG tax can be reduced from 20% to around 5-7%, resulting in lower tax liability.

It’s important to note that the specific CII values for each financial year may vary, so it’s necessary to refer to the latest CII values provided by the government for accurate calculations of indexation and tax liability.

Debt Funds Tax Details

Tax treatment of debt funds in India can vary based on the holding period and the type of fund. Here are the tax details for debt funds:

- Short-term Capital Gains (STCG):

- Holding Period: Up to 3 years

- Tax Rate: Taxed at the individual’s applicable income tax slab rate

- Applicable for: All types of debt funds

- Long-term Capital Gains (LTCG):

- Holding Period: More than 3 years

- Tax Rate: Taxed at 20% with indexation benefit

- Applicable for: All types of debt funds

- Indexation Benefit:

- Indexation helps adjust the purchase price of the investment for inflation, reducing the taxable capital gains.

- It is calculated using the Cost Inflation Index (CII) published by the government for the respective financial years.

- Dividend Distribution Tax (DDT):

- Debt funds may distribute dividends to investors, and the fund house deducts DDT before distributing dividends.

- DDT rate is 29.12% (including surcharge and cess) for individual investors.

- Tax Deducted at Source (TDS):

- TDS is applicable on interest income from debt funds if it exceeds a certain threshold.

- For individuals, TDS is applicable if the annual interest income exceeds Rs. 5,000.

- The TDS rate is 10%, and the TDS deducted is adjustable against the total tax liability.

- Systematic Withdrawal Plan (SWP):

- SWP is a facility provided by debt funds where investors can withdraw a fixed amount periodically.

- The withdrawn amount is subject to tax based on the capital gains tax rules mentioned above.

Disadvantages of investing in Debt Funds

While investing in debt funds offers several benefits, there are also some disadvantages that investors should be aware of. Here are some key disadvantages of investing in debt funds:

Lower Potential Returns: Compared to other investment options like equities or real estate, debt funds generally offer lower potential returns. They are designed to provide steady income and capital preservation rather than high growth. If you have a higher risk tolerance and are seeking substantial capital appreciation, debt funds may not be the most suitable investment choice.

Interest Rate Risk: Debt funds are sensitive to changes in interest rates. When interest rates rise, the prices of existing debt securities in the fund’s portfolio tend to decline, negatively impacting the fund’s net asset value (NAV). Conversely, when interest rates fall, the prices of existing securities rise, resulting in capital appreciation. Investors in debt funds are exposed to interest rate risk, and changes in interest rates can impact their returns.

Credit Risk: Debt funds invest in a variety of fixed-income instruments issued by governments, corporations, and other entities. These instruments carry varying degrees of credit risk. Lower-rated or riskier securities may offer higher yields but also pose a higher risk of default. While debt funds generally aim to manage credit risk through diversification and credit analysis, there is still a possibility of defaults or downgrades that can impact the fund’s performance.

Lack of Liquidity: Some categories of debt funds may have liquidity constraints. For example, funds that invest in longer-term bonds or illiquid securities may have limited liquidity, making it challenging to sell your units and access your investment when desired. It’s important to consider the liquidity profile of the debt fund and ensure it aligns with your investment horizon and liquidity needs.

Inflation Risk: Debt funds may be susceptible to inflation risk. Inflation erodes the purchasing power of money over time. If the returns generated by the debt fund do not outpace inflation, the real value of your investment can decline. Investors should consider the potential impact of inflation and aim for investments that can provide adequate returns to combat inflationary pressures.

Lack of Transparency: Debt funds, especially those investing in complex or structured debt securities, may have limited transparency. It can be challenging for individual investors to fully understand the underlying holdings, valuation methodologies, and associated risks of such securities. Lack of transparency can make it difficult to assess the true risk profile and performance of the fund.

Regulatory Changes: Changes in regulatory norms or tax regulations can impact the functioning and returns of debt funds. Alterations in tax treatment, investment guidelines, or other regulatory requirements can affect the fund’s composition, returns, and overall attractiveness as an investment option.

Management and Default Risk: The performance of a debt fund is influenced by the skills and expertise of the fund manager. Inadequate management or poor investment decisions can negatively impact the fund’s returns. Additionally, although debt funds aim to manage credit risk, there is still a risk of default by the issuers of the underlying debt securities, which can adversely affect the fund’s performance.

It’s important to evaluate these disadvantages in the context of your own financial situation, risk tolerance, and investment goals. Consider diversifying your investment portfolio, understanding the risks involved, and seeking professional advice when needed to make informed decisions about investing in debt funds.

Top mistakes to avoid while investing in Debt Funds

When investing in debt funds, it’s important to avoid certain common mistakes to make informed decisions and maximize your potential returns. Here are some top mistakes to avoid:

Neglecting to Understand the Risk: Debt funds are not risk-free investments. It’s crucial to understand the risks associated with debt funds, such as interest rate risk, credit risk, and liquidity risk. Neglecting to evaluate these risks can lead to unexpected losses or inadequate returns.

Ignoring Investment Objectives: Investing in debt funds without considering your investment objectives can be a mistake. Various types of debt funds are tailored to specific objectives, be it generating income, safeguarding capital, or a blend of both. Align your investment objectives with the appropriate category of debt funds to achieve your financial goals effectively.

Chasing High Yields without Assessing Risks: While higher yields can be tempting, it’s essential to evaluate the underlying risks associated with those yields. High-yield debt funds often invest in lower-rated or riskier securities, which come with increased credit risk. Consider the risk-reward trade-off and assess whether the potential returns are justified by the associated risks.

Not Diversifying: Lack of diversification is a common mistake. Spreading your investments across different debt funds or asset classes can help reduce the impact of any single investment’s performance. Diversification can mitigate risks and enhance portfolio stability.

Ignoring Expense Ratios: Expense ratios represent the annual cost of managing a mutual fund and are deducted from its returns. Disregarding expense ratios could dent your overall returns. When selecting debt funds, it’s crucial to compare their expense ratios and opt for ones with modest fees to enhance your investment returns.

Failing to Monitor the Fund: Once you invest in a debt fund, it’s important to regularly monitor its performance and review any changes in its portfolio or fund manager. Staying informed about the fund’s holdings, credit quality, and market conditions will help you make timely adjustments or decisions.

Market Timing: Trying to time the market by entering or exiting debt funds based on short-term market movements can be challenging. Timing the market accurately is difficult even for professional investors. Instead, focus on a disciplined investment approach and consider long-term trends rather than short-term fluctuations.

Overlooking Tax Implications: Debt fund investments can have tax implications. It’s crucial to understand the tax treatment of debt funds, including capital gains tax and indexation benefits, if applicable in your country. Consider the tax implications while making investment decisions to optimize your after-tax returns.

Emotional Decision-Making: Emotional decision-making, such as reacting impulsively to short-term market movements or following trends blindly, can lead to poor investment choices. Base your decisions on thorough research, analysis, and a long-term perspective, rather than succumbing to emotional biases.

Not Seeking Professional Advice: Investing in debt funds can be complex, especially for inexperienced investors. Failing to seek professional advice or guidance from a financial advisor can result in suboptimal investment decisions. A financial advisor can help you navigate the complexities of debt funds and align your investments with your financial goals.