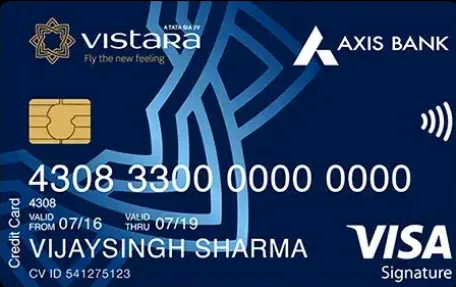

Axis Bank Vistara Signature Credit Card

Discover a world of elevated travel experiences with the Axis Bank Vistara Signature Credit Card. Your gateway to seamless journeys, this card is designed to transform the way you explore the skies. From exclusive lounge access to rewarding miles, embark on a voyage where every moment is tailored to your wanderlust. Join us as we redefine travel with a card that brings together luxury, convenience, and the joy of discovery.

Key Highlights of Axis Bank Vistara Signature Credit Card

| Joining fee | Rs. 3,000 |

| Annual fee | Rs. 3,000 |

| Benefits | CV points, complimentary Club Vistara membership, insurance benefits, etc. |

| Welcome benefit | A complimentary premium economy class ticket voucher on fee payment |

| Rewards | 4 CV points on spending every Rs. 200 |

| Age | 18 to 70 years |

| Foreign currency transaction fee | 3.50% of the transaction value |

Features and Benefits of Axis Bank Vistara Signature Credit Card

Welcome Benefits: You get a complimentary Premium Economy Class air ticket and Club Vistara Silver Membership.

Movie & Dining: Enjoy a 25% discount of up to Rs. 800 at various restaurants across India with Axis Bank’s EazyDiner Program.

Rewards Rate: Earn 4 CV (Club Vistara) Points for every Rs. 200 you spend.

Reward Redemption: Use Club Vistara Points to book award flights, class upgrades, or for any seat reservation under the Vistara Cash + Points program (1 CV Point = Rs. 0.20).

Travel: Get Club Vistara Silver Membership, a complimentary Premium Economy Class ticket, and complimentary access to domestic airport lounges.

Golf: Enjoy 3 Complimentary Golf sessions at some of India’s most premium golf destinations.

Domestic Lounge Access: Get complimentary access to domestic lounges up to 2 times in a quarter.

Insurance Benefits: Avail purchase protection cover worth up to Rs. 1 lakh and cover worth USD 300 against loss of travel documents and delay/loss of check-in baggage.

Zero Liability Protection: You won’t be liable for any fraudulent transactions made using your credit card after reporting the loss or theft of the card to the bank.

Axis Bank Vistara Signature Credit Card Fees and Charges

Joining Fee: Rs. 3,000 (plus applicable taxes)

Renewal Fee: Rs. 3,000 (plus GST)

Foreign Currency Markup: 3.5% of the transaction amount

Interest Rates: 3.6% per month (52.86% per annum)

Fuel Surcharge: 1% of transaction amount

Cash Advance Charge: 2.5% of the amount withdrawn (subject to a minimum charge of Rs. 500)

Add-on Card Fee: Nil

Axis Bank Vistara Signature Credit Card Eligibility

To be eligible for the Axis Bank Vistara Infinite Credit Card, you should meet the following criteria:

Age: The primary cardholder must be between 18 years and 70 years old.

Income: You should have a net income of at least Rs. 6,00,000 per year.

Residency: You must be a resident of India.

Documents Required for Axis Bank Vistara Signature Credit Card

- PAN card photocopy or Form 60.

- Proof of income, which can be the latest payslip, Form 16, or IT return copy.

- Residence proof, which can be any one of the following documents:

Passport

Driving License

Ration card

Electricity bill

Landline telephone bill

How to apply for Axis Bank Vistara Signature Credit Card?

To apply for the Axis Bank Vistara Signature Credit Card, you can follow these steps:

Visit the Axis Bank website: Go to the official website of Axis Bank (www.axisbank.com).

Navigate to Credit Cards: Look for the “Credit Cards” section on the website’s main menu.

Explore Credit Card options: Browse through the various credit card options offered by Axis Bank, including the Vistara Signature Credit Card. Compare the features, benefits, and fees associated with each card to find the one that suits your needs best.

Check eligibility: Before proceeding with the application, make sure you meet the eligibility criteria, which typically include factors like age, income, and credit score.

Fill out the application form: Once you have chosen the Axis Bank Vistara Signature Credit Card, click on the “Apply Now” or “Apply Online” button. Fill out the online application form with accurate personal and financial details.

Upload required documents: Scan and upload the necessary documents, such as identity proof, address proof, income proof, and a recent passport-size photograph, as per the bank’s guidelines.

Review and submit: Double-check all the information you have provided in the application form. If everything looks correct, submit the application.

Wait for approval: The bank will review your application and documents. If you meet the criteria and your application is approved, the bank will dispatch the credit card to your registered address.

Activate the card: Upon receiving the card, you may need to follow the instructions provided by the bank to activate the card before you start using it.

Axis Bank’s Other Cards

Axis Bank Neo Credit Card

Axis Bank My Zone Credit Card

Axis Bank SELECT Credit Card

IndianOil Axis Bank Credit Card

Axis Bank Magnus Credit Card

Flipkart Axis Bank Credit Card

Axis Bank Vistara Credit Card

Axis Bank Rewards Credit Card

Axis Bank Vistara Infinite Credit Card

Axis Bank Ace Credit Card

Axis Bank Privilege Credit Card

Axis Bank Reserve Credit Card

Axis Bank Atlas Credit Card

Flipkart Axis Bank SuperElite Credit Card

Airtel Axis Bank Credit Card

Samsung Axis Bank Infinite Credit Card

Samsung Axis Bank Signature Credit Card

SpiceJet Axis Bank Voyage Black Credit Card

SpiceJet Axis Bank Voyage Credit Card

Axis Bank AURA Credit Card

Axis Bank Freecharge Plus Credit Card

Axis Bank Freecharge Credit Card

Axis Bank Miles & More Credit Card

Axis Bank Burgundy Private Credit Card

Axis Bank KWIK RuPay Credit Card

Axis Bank My Zone Easy Credit Card

Axis Bank Platinum Credit Card

Axis Bank My Wings Credit Card

Axis Bank Titanium Smart Traveler Credit Card

Axis Bank Pride Signature Credit Card

Axis Bank Pride Platinum Credit Card

Axis Bank Buzz Credit Card

Frequently Asked Questions (FAQs) -

The Axis Bank Vistara Signature Credit Card is a premium credit card offered by Axis Bank in collaboration with Vistara, a leading airline in India. It is designed to provide cardholders with exclusive travel benefits, rewards, and privileges.

The card comes with features such as complimentary air tickets, airport lounge access, accelerated reward points on Vistara and general spending, and discounts on dining and lifestyle.

You can apply for the Axis Bank Vistara Signature Credit Card through the Axis Bank official website, by visiting a local Axis Bank branch, or by contacting the Axis Bank credit card customer care.

Eligibility criteria may vary, but generally, applicants should have a good credit score, a regular source of income, and meet the bank’s specified age criteria. It’s advisable to check with Axis Bank for the most up-to-date eligibility requirements.

Yes, the card may have an annual fee. However, some fees may be waived off based on the spending patterns and promotional offers. Please refer to the latest terms and conditions or contact Axis Bank for specific details.

Cardholders can enjoy benefits such as complimentary Vistara tickets, priority check-in, additional baggage allowance, and access to airport lounges across India.

The Axis Bank Vistara Signature Credit Card typically offers accelerated reward points for spending on Vistara and other categories. These points can be redeemed for various rewards, including flights, hotel bookings, and merchandise.

Yes, there may be foreign transaction charges. It’s essential to review the fee structure provided by Axis Bank for international transactions and currency conversion.

Yes, Axis Bank usually provides the option to convert high-value purchases into EMIs. You can check with the bank for the specific terms and conditions regarding this feature.

You can access your credit card statement online through the Axis Bank internet banking portal or mobile app. Statements are usually sent to the registered email address as well.